Who Really Competes With Amazon in 2025?

Amazon is that overachiever from high school who did varsity sports, debate club, jazz band, and somehow still launched a startup before graduation.

Impressive? Yes.

Unbeatable? Not even close.

Behind the Prime hype, free shipping, and 2‑day (or faster) delivery, Amazon is taking hits from all directions: retail, cloud computing, streaming, digital advertising, and grocery. Different battlefields, different Amazon competitors, very different games.

This breakdown maps the real Amazon competition in 2025—by business line, not by brand halo.

Amazon Isn’t One Business—It’s a Stack of Empires

Talking about “Amazon competitors” as if there’s one tidy list is like asking, “Who competes with Disney?”

Do you mean theme parks, movies, streaming, merchandise, or your kid’s imagination?

Same with Amazon. Under one logo, you’ve actually got multiple mini‑empires—and each has its own set of top Amazon competitors:

- E‑commerce & marketplaces – Amazon.com, 3P marketplace

- Cloud computing – AWS (Amazon Web Services)

- Digital content & streaming – Prime Video, Twitch, Audible

- Advertising – Amazon Ads / retail media

- Grocery & physical retail – Whole Foods, Amazon Fresh, Amazon Go

Each business line has its own boss battle. So instead of “top 10 Amazon rivals,” it’s more useful to build a segmented map of who’s fighting where—and how.

If you’re trying to understand Amazon competitors in 2025, you need to look at each arena separately.

1. E‑Commerce & Marketplaces: The Main Event

This is the Amazon most shoppers think of first: the search bar where you type “phone charger” and get 9,000 options, including one that might burn your house down.

In U.S. retail e‑commerce, Amazon is still the big kid on the playground, capturing 40%+ of all retail e‑commerce sales in 2025. It’s miles ahead of Walmart, Apple, eBay, and most other Amazon alternatives.

But zoom out globally—or drill into niches—and the Amazon competition looks a lot more intense.

1.1 Walmart: The Omnichannel Heavyweight

If Amazon is the internet’s mall, Walmart is America’s front yard.

- Walmart is the #2 online retailer in the U.S., with tens of billions in e‑commerce sales and consistent double‑digit growth.

- Its 4,700+ U.S. stores function as local fulfillment centers: same‑day delivery, curbside pickup, in‑store returns—things Amazon can’t easily replicate without owning every strip mall in America.

How Walmart challenges Amazon in e‑commerce:

- Omnichannel superpower

– Order online, pick up in store.

– Return that 11 p.m. impulse buy in 30 seconds at the service desk.

– Check real‑time local inventory before leaving the house.

For busy families, this experience often beats “Prime in 2 days.” - Price perception

Walmart’s entire brand is: “We’re cheap, and we know it.”

On everyday essentials, it can match or undercut Amazon—and more importantly, shoppers believe Walmart will be cheaper, which is half the battle. - Grocery dominance

Walmart is the online grocery leader in the U.S., ahead of Amazon Fresh. Groceries create habits. If someone is already ordering milk and eggs from Walmart, adding paper towels and shampoo is a tiny extra step.

1.2 Alibaba Group: The Global Marketplace Giant

Plot twist: by GMV (gross merchandise volume), Alibaba is bigger than Amazon globally.

- Alibaba ≈ 23% of global GMV

- Amazon ≈ 12%

(Yes, Amazon is #2. The internet has layers.)

Alibaba isn’t a single website; it’s an ecosystem of marketplaces and platforms that compete with Amazon in different ways:

- Taobao & Tmall – China’s core C2C and B2C marketplaces

- AliExpress – China‑to‑world cross‑border marketplace

- Alibaba.com – Global B2B sourcing and wholesale

How Alibaba competes with Amazon:

- Factory‑to‑buyer pricing

On AliExpress, shoppers are often buying almost directly from manufacturers. Middlemen get erased, and prices reflect that. - Global export infrastructure

Manufacturers use Alibaba to sell directly to global retailers, Amazon sellers, and end consumers. Alibaba isn’t just an Amazon alternative; it’s also the supply engine behind many Amazon listings. - APAC stronghold

In China and much of Southeast Asia, people don’t “check Amazon” by default. They start with Alibaba platforms.

1.3 eBay: The Treasure Hunter’s Paradise

eBay is like that band you loved in high school. You don’t talk about them much anymore, but they’re still touring and doing just fine.

It remains a top U.S. e‑commerce player, especially for:

- Used and refurbished products

- Collectibles and rare items

- Auction‑style and C2C sales

eBay’s market share is in the single digits versus Amazon’s ~40% in U.S. e‑commerce, but it dominates a very specific lane:

- It owns the pre‑owned / collector / “slightly sketchy but fascinating” niche.

- Amazon has never seriously tried to copy eBay’s auction culture or its C2C format.

1.4 Target, Best Buy, Costco & the Big‑Box Squad

Individually, these retailers are smaller than Amazon. Collectively, they’re extremely annoying to it.

Target

- Leans into design‑forward, slightly‑upscale vibes and strong private‑label brands.

- Invests heavily in same‑day fulfillment via Shipt, curbside pickup, and drive‑up options.

- Operates Roundel, its own retail media network—essentially “Amazon Ads, but in red.”

Best Buy

- Dominates consumer electronics both online and in‑store.

- Offers in‑person demos, advice, and Geek Squad installation/support.

- This “come touch the TV and talk to a human” experience is something Amazon struggles to match.

Costco

- Runs on a membership‑driven, bulk‑buying cult model.

- Competes directly with Amazon’s bulk offerings and Subscribe & Save.

- Wins with low margins, large pack sizes, and intense customer loyalty.

1.5 Global & Niche Marketplaces: Death by a Thousand Segments

Outside the U.S., Amazon is often not the default shopping app. Other Amazon alternatives dominate their home turf:

- China: JD.com, Pinduoduo

- India: Flipkart

- Southeast Asia: Shopee

- Europe: Otto, Zalando

- Japan: Rakuten

At the same time, niche marketplaces go after specific verticals where the “everything store” model isn’t ideal:

- Etsy – Handmade, vintage, and “I could maybe make that, but I won’t” goods.

- Wayfair – Furniture and home goods, with deep catalog and richer content than a tiny Amazon thumbnail.

- DTC brands – Warby Parker, Allbirds, Glossier, and others skip Amazon entirely to own the customer relationship.

1.6 New Chaos Agents: Temu, Shein & TikTok Shop

Then you’ve got the disruptors.

Temu & Shein

- Push ultra‑low prices that make Amazon’s “deal of the day” look bougie.

- Use direct‑from‑manufacturer sourcing plus aggressive discounting and promotions.

- Grow virally through social media, creators, and gamified apps.

TikTok Shop

- Lets shoppers buy directly inside TikTok. See it, like it, buy it—before the video ends.

- Merges discovery + entertainment + checkout in a single scroll.

Strategically, this is dangerous for Amazon because:

- Gen Z is increasingly starting product discovery on TikTok, Shein, or Temu—not on Amazon.

- Discovery is shifting from “type keyword into a search bar” to “algorithm serves it to you.”

2. Cloud Computing: AWS vs. the Other Sky Gods

Behind every streaming service, AI model, SaaS app, and questionable crypto project sits a very real cloud bill.

AWS (Amazon Web Services) is Amazon’s profit engine and remains #1 in cloud infrastructure with roughly 29–31% global market share in 2025.

But the other hyperscalers are not playing support roles.

2.1 Microsoft Azure: The Enterprise Favorite

Azure holds roughly 20–23% of global cloud market share, making it AWS’s closest rival.

Azure’s competitive edge against AWS:

- Microsoft ecosystem integration

If your IT department lives inside Windows Server, Office/Microsoft 365, and Active Directory, Azure feels native.

Azure slots neatly into existing enterprise workflows. - Hybrid cloud strength

Many large companies don’t want to go 100% cloud. They want a hybrid mix of on‑premises infrastructure and cloud services. Azure leaned into this hybrid model early. - AI stack, Copilot & OpenAI integration

Azure is tightly woven into Microsoft’s AI strategy—from enterprise copilots to custom AI services powered by OpenAI.

2.2 Google Cloud Platform (GCP): The Data Nerd

Google Cloud holds about 10–13% global market share. Smaller than AWS and Azure, but disproportionately influential in data‑heavy and analytics‑driven businesses.

Why teams choose GCP over AWS or Azure:

- BigQuery & analytics – Industry‑leading data warehousing, analytics, and BI tooling.

- Open‑source credibility – Kubernetes, TensorFlow, and general “developer‑friendly” reputation.

- AI & ML strengths – Strong machine learning tools, model training infrastructure, and ML‑ops capabilities.

Many companies adopt a multi‑cloud strategy: AWS for core infrastructure, GCP for analytics and AI, maybe Azure for Microsoft‑centric workloads.

2.3 Other Cloud Rivals: The Specialists

Not everything runs on the big three.

- Alibaba Cloud – #4 globally, dominant in China, gaining ground in APAC. Important if you operate heavily in Asia.

- Oracle Cloud – Go‑to choice for Oracle database–heavy stacks and specific enterprise workloads.

- IBM Cloud, Salesforce, Tencent Cloud – Relevant in particular verticals, geographies, or high‑compliance environments.

These platforms don’t dethrone AWS, but they slice off profitable niches and keep pressure on pricing and feature velocity.

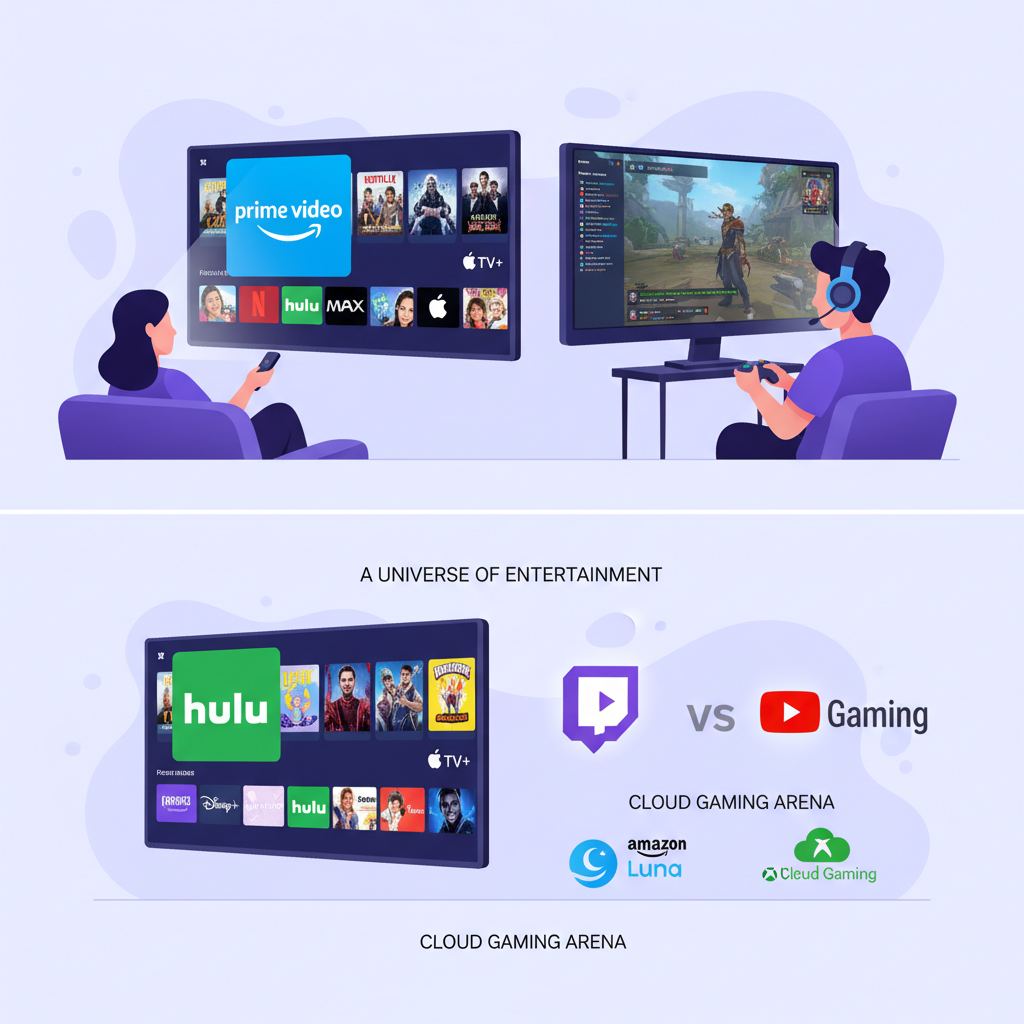

3. Streaming & Digital Content: Prime Video, Twitch & Co.

You signed up for shipping; you stayed for The Boys and Thursday Night Football. That’s Amazon’s content strategy in a nutshell.

Some estimates put Prime Video at ~20–22% of U.S. subscription streaming in 2025—essentially neck‑and‑neck with Netflix for the top spot.

The Main Streaming Competitors

- Netflix – Still the global benchmark. Huge catalog, strong originals, and deep international reach.

- Disney+ / Hulu / ESPN+ – Families, franchises (Marvel, Star Wars, Pixar), and live sports. That combo is hard and expensive to counter.

- Max (HBO), Paramount+, Peacock – Big back catalogs and valuable sports rights of their own.

- Apple TV+ – Lean catalog of very polished originals, tied tightly into Apple’s hardware ecosystem.

How Amazon competes in streaming:

- Bundle arbitrage

Prime Video is bundled into the broader Prime membership with shipping, music, and other perks. Shoppers rarely decide “Should I pay just for Prime Video?”—they already have it, then discover the content. - Live sports and blockbuster originals

Amazon pours serious money into tentpoles like NFL Thursday Night Football, The Lord of the Rings: The Rings of Power, and region‑specific originals. - Cross‑promotion flywheel

Fire TV, Alexa, the Amazon homepage, and even Kindle devices all push viewers toward Prime content—and Prime content pushes viewers back to Amazon shopping.

On the gaming and creator side:

- Twitch goes head‑to‑head with YouTube Gaming and other live‑streaming platforms for creator attention.

- Amazon Luna explores cloud gaming alongside Xbox Cloud Gaming and NVIDIA GeForce Now—still niche, but strategically important.

4. Advertising: Amazon vs. Google & Meta for Your Ad Dollars

Somewhere along the way, Amazon quietly morphed into an ad giant. Brands now pay handsomely to be the first thing shoppers see when they search “toothpaste.”

Amazon’s ad business generates tens of billions in annual revenue, growing north of 20% year over year.

Amazon’s Main Advertising Competitors

- Google (Alphabet) – Dominates search advertising and YouTube video ads. Still the default for “intent + eyeballs.”

- Meta (Facebook & Instagram) – Owns social discovery, interest‑based targeting, and performance‑driven campaigns through Feed, Stories, and Reels.

Amazon’s unfair advantage in advertising:

It owns the checkout moment.

- When you advertise on Amazon, shoppers are usually in “I’m about to buy something” mode.

- Conversion rates are high and advertisers can tie ad spend directly to revenue. CFOs love that.

Meanwhile, other retailers are building their own retail media networks to compete with Amazon Ads:

- Walmart Connect, Target Roundel, Instacart Ads, Kroger Precision Marketing, and others all pitch the same idea:

“Advertise with us; we control both eyeballs and receipts.”

5. Grocery & Physical Retail: The Mundane, Massive Battlefield

Groceries aren’t glamorous, but they quietly drain a huge share of consumer spend every single week.

Amazon attacks this space via:

- Whole Foods

- Amazon Fresh

- Same‑day and 2‑hour delivery options in select markets

Unlike online retail, Amazon is not the dominant player in grocery.

The Real Grocery Bosses

- Walmart – Again. It’s #1 in U.S. grocery, both offline and online.

- Traditional grocers – Kroger, Albertsons, plus a zoo of strong regional chains. They have:

- Habit (the weekly grocery trip)

- Proximity (stores close to home)

- Long‑standing relationships with shoppers

- Instacart, DoorDash

They don’t own farms or stores, but they control:- The app customers open

- The data and shopping interface

- The last‑mile delivery experience

That means these intermediaries own a big slice of the customer relationship, even when the groceries come from a different brand’s store.

Amazon’s grocery problem:

For pantry staples, sure—people trust Amazon. But for fresh food and weekly habits, many shoppers still prefer:

- To see and inspect produce and meat

- To trust their local store

- To stick with the shopping routines they’ve always had

6. Where Amazon Still Has a Real Edge

After all this talk about Amazon competitors, why is the company still so effective?

Because some of its structural advantages are incredibly hard to copy:

- Logistics & scale

Amazon’s fulfillment network is a marvel of speed, density, and automation. Competing with that as a smaller retailer or marketplace is brutal. - Prime ecosystem

Free shipping, video, music, gaming perks, exclusive deals—bundled into one subscription. Most Amazon alternatives can match one or two of those benefits, not the entire bundle. - Cloud + retail synergy

AWS prints cash, and that cash funds long‑term bets in retail, devices, and AI. Amazon is also its own best AWS showcase—battle‑testing infrastructure at enormous scale. - Data & personalization

Shopping history, watch history, browsing behavior, device usage—all feed into extremely effective recommendations and ad targeting.

7. What This Means for Brands, Sellers & Builders

Here’s where all this analysis about Amazon competition actually becomes useful.

7.1 Don’t Build Your Life on One Platform

If 90–100% of your revenue comes from Amazon Marketplace, you’re living dangerously.

- Fees change.

- Policies shift.

- Competitors can outspend you on Amazon Ads or copy your listing overnight.

Diversify your channels:

- List on Walmart.com, eBay, Etsy, TikTok Shop, and relevant regional marketplaces.

- Build and invest in your own Shopify or DTC site so you control your customer list, margins, and brand.

7.2 Lean Into What Amazon Is Bad At

Look for areas where Amazon’s strengths don’t translate into an advantage:

- Brand‑heavy experiences – Luxury, premium, or story‑driven brands usually do better in their own storefronts or curated platforms than on a crowded Amazon results page.

- Community‑driven products – Think Etsy sellers, fandom‑driven merch, Patreon‑style creator products, or niche communities.

- Service‑intensive offerings – Installation, customization, consulting, or support‑heavy products that can’t be reduced to a simple Buy Now button.

7.3 Treat AWS as a Powerful Option—not the Default

If you’re building software, SaaS, or AI products:

- Evaluate Azure for its enterprise integration and AI copilots.

- Consider GCP if analytics, ML, and data engineering are core to your business.

- Think about multi‑cloud or hybrid strategies when they help with resilience, compliance, or pricing leverage.

7.4 Look Beyond Amazon Ads

If you’re running paid media:

- Test Walmart Connect, Target Roundel, Instacart Ads, and other retail media networks in your category.

- Map your ad spend to where your customers actually shop, not just where they might browse or research.

Conclusion: Amazon Is Dominant—but It Shares the Playground

Amazon leads in:

- U.S. e‑commerce

- Global cloud infrastructure via AWS

- A rapidly growing ads and streaming stack layered on top

But it does not operate alone, and it’s not a monopoly in any of its major arenas. Real Amazon competitors are everywhere:

- E‑commerce: Walmart, Alibaba, regional marketplaces, Temu, Shein, TikTok Shop, and niche players all carve out serious territory.

- Cloud computing: Azure and GCP are credible, fast‑growing rivals with their own superpowers.

- Streaming & digital content: Netflix, Disney, and traditional media giants are anything but passive.

- Advertising: Google and Meta still dominate digital ad share while retail media networks rise around Amazon Ads.

- Grocery: Walmart, local grocers, and app‑based intermediaries still own a huge share of everyday spend.

For brands, sellers, and builders, the moral is straightforward:

- Don’t treat Amazon as the only gatekeeper.

- Do treat it as a critical piece of a broader, multi‑platform strategy.

Use Amazon where it’s strong. Avoid it where it’s weak. And remember: even the “Everything Store” doesn’t get to own everything.

Leave a Reply