How To Contact A Seller On Amazon

You found the almost perfect item on Amazon… but you’ve got questions.

Is this actually compatible with your device?

Can it arrive before your trip?

Why does the size chart look like a math problem?

For all of that, you’ll want to contact the Amazon seller directly.

The good news: it’s pretty easy once you know where to click.

The bad news: Amazon does a great job of hiding that tiny “Contact” link like it’s a national secret.

This guide walks you through exactly how to contact a seller on Amazon on desktop, mobile app, before buying, and after buying—plus what to say so you actually get a helpful answer.

Quick Overview: Ways You Can Contact an Amazon Seller

You can contact a seller on Amazon in three main situations:

- Before you buy – to ask about product details, shipping, compatibility, etc.

- After you buy (order not yet delivered) – to ask about shipping, changes, or issues.

- After delivery – to resolve problems like missing parts, defects, or wrong item.

The basic pattern is:

- Find the product page or your order

- Look for the seller’s name

- Click something like “Contact seller” or “Ask a question”

We’ll go step-by-step for each scenario, with both desktop and mobile.

Step 1: How to Tell If You’re Buying From Amazon or a Third-Party Seller

Before you even try to contact someone, it helps to know who you’re talking to.

On the product page, look under the price or near the Buy Now/Add to Cart buttons. You’ll usually see lines like:

- “Ships from: Amazon”

- “Sold by: [Seller Name]”

Here’s how to read that:

- Sold by Amazon → You’re buying directly from Amazon.

- Sold by Third-Party Seller, Fulfilled by Amazon → Independent seller uses Amazon’s warehouse.

- Sold by Third-Party Seller, Ships from Third-Party → Independent seller handles everything.

Why this matters:

- If the product is sold by Amazon, you’ll mainly work with Amazon Customer Service.

- If it’s sold by a third-party, you can (and usually should) contact the seller first about item-specific problems.

How to Contact a Seller on Amazon Before Buying

Say you’re shopping and you want to ask:

- “Does this work with iPhone 15?”

- “Is there a warranty?”

- “Are the shoes true to size?”

You don’t need to buy first. Here’s how to reach out.

On Desktop (Browser)

- Open the product page on Amazon.

- On the right side (near the Buy Now box), find “Sold by [Seller Name]”.

- Click the seller’s name (it’s a link).

- You’ll land on the seller’s profile page.

- Look for a button like “Ask a question” or “Contact seller.”

- Click it, then choose a topic (e.g., “Product details,” “Shipping,” etc.).

- Type your message and hit Send.

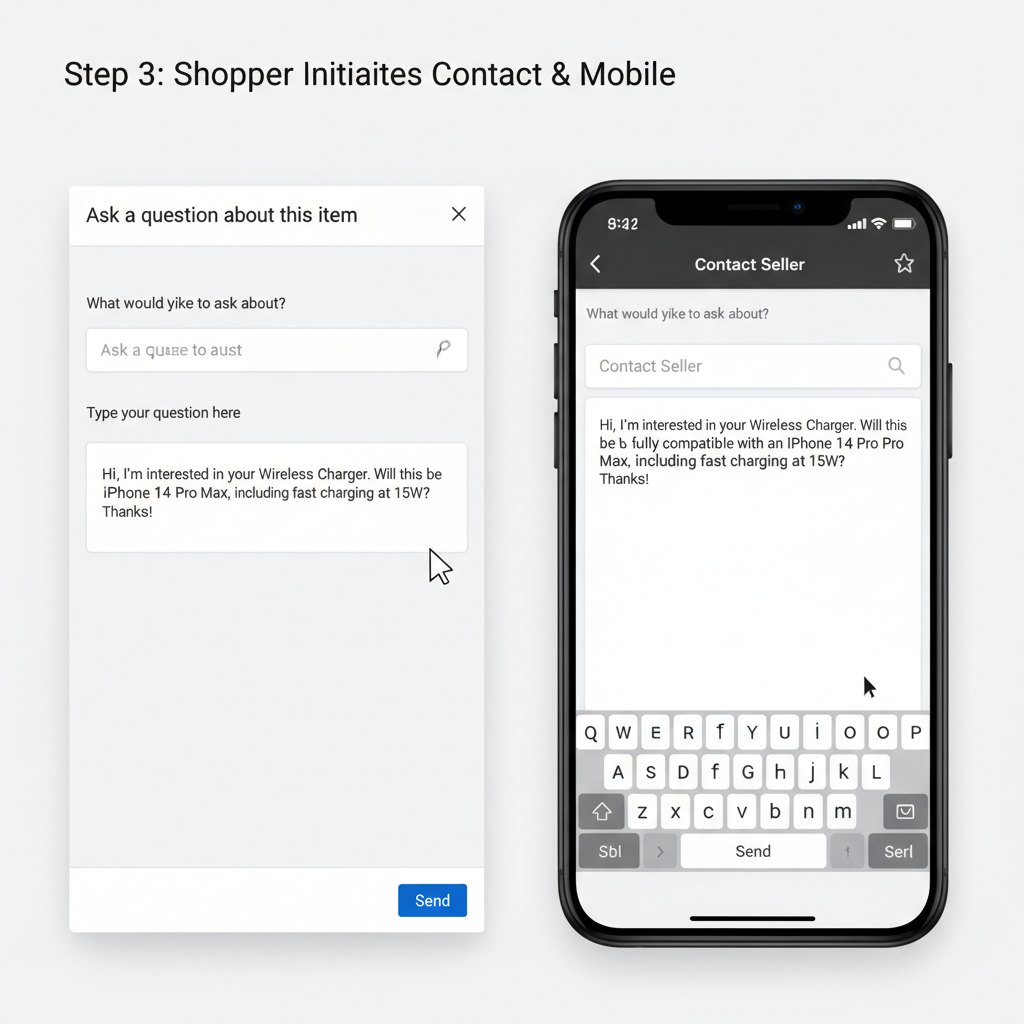

On Mobile (Amazon App)

- Open the Amazon app and go to the product page.

- Scroll down a bit until you see “Sold by [Seller Name]”.

- Tap the seller’s name.

- On the seller’s profile page, tap “Ask a question” or “Contact seller.”

- Pick your topic/category.

- Type your question and send.

Pro Tip: Be specific. Instead of “Will this work?”, ask “Will this work with a 2023 MacBook Pro (M2, 16-inch)?”

How to Contact a Seller on Amazon After You Order

Already placed an order and now something’s wrong—or you just want an update?

Common reasons to contact a seller after ordering:

- You entered the wrong address (and are praying it’s not too late).

- You want to change color/size before it ships.

- You’re worried the package is late.

- You want clarification on tracking info.

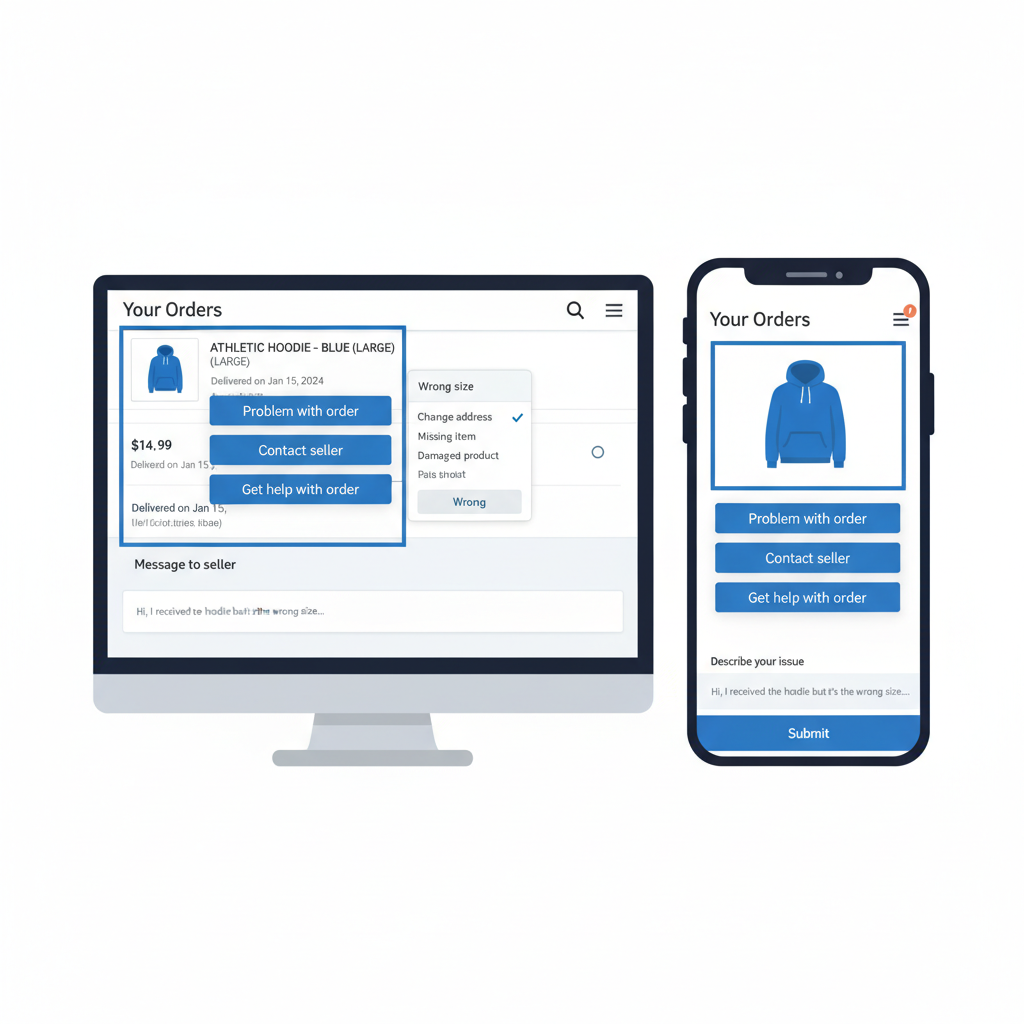

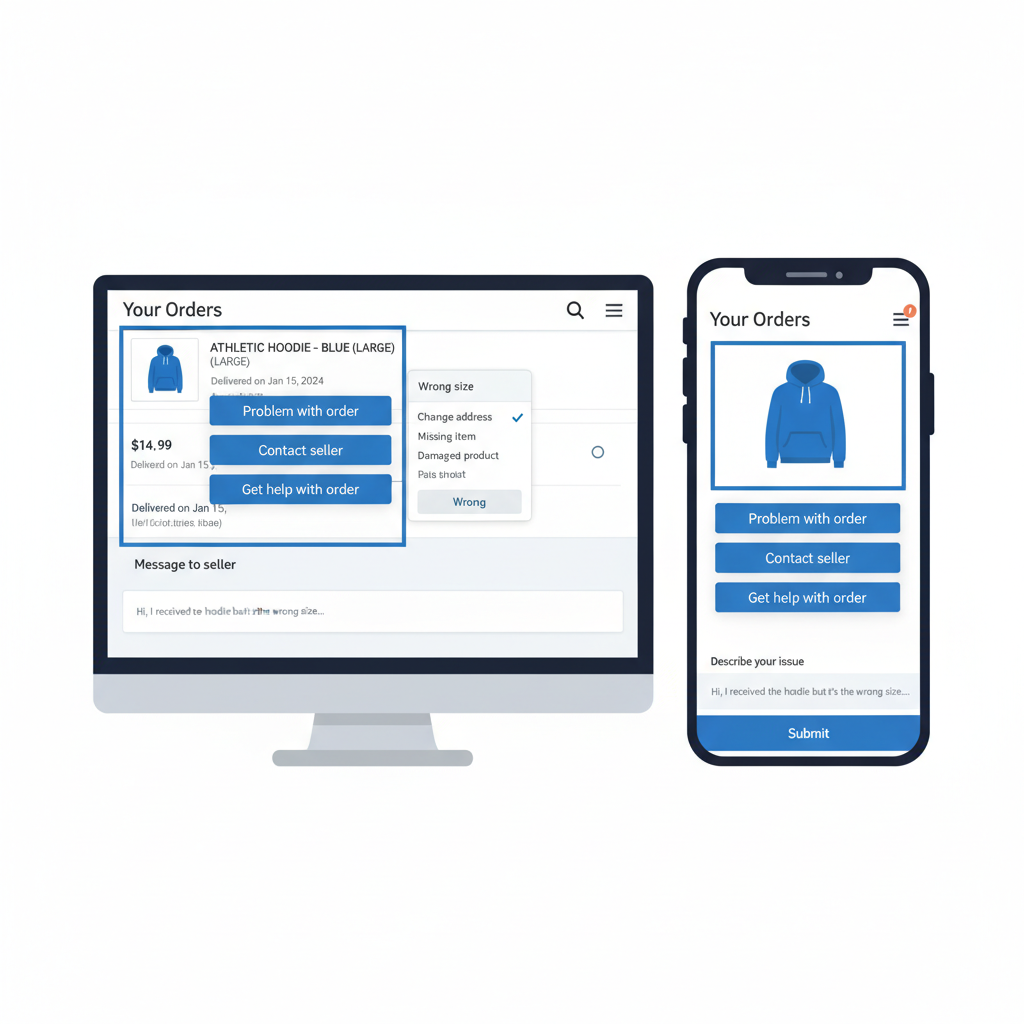

On Desktop (Browser)

- Go to Amazon.com and make sure you’re signed in.

- Hover over or click “Returns & Orders” (top-right).

- Find the order you’re concerned about.

- Click “Problem with order” or “Order details”.

- Look for a button like “Contact seller” or “Get help with order.”

- Choose your issue type from the dropdown.

- You’ll be guided to messaging options. When available, choose “Message seller”.

On Mobile (Amazon App)

- Open the Amazon app.

- Tap the person icon or menu icon, then go to “Your Orders.”

- Find the item/order you’re worried about.

- Tap “Order details” or “Problem with order.”

- Scroll until you see “Contact seller” or “Get help with order.”

- Select your issue category.

- Write and send your message.

Note: For some issues (like delivery problems with Amazon drivers), Amazon may route you to Amazon Customer Service instead of the seller.

How to Contact a Seller on Amazon After Delivery

So the package arrived, but:

- The item is defective

- It’s not as described

- Parts are missing

- You got the wrong color/size/entirely different thing (it happens)

Here’s what to do.

Step 1: Decide – Contact Seller vs. Start a Return

- If you want a quick replacement, missing part, or clarification, start by messaging the seller.

- If you mainly want your money back, you can often go straight to “Return or replace items” under Your Orders.

Step 2: Message the Seller (Desktop & Mobile)

The process is almost identical to contacting them after ordering:

- Go to Your Orders.

- Find the item.

- Click or tap “Problem with order.”

- Choose the type of issue (e.g., “Item defective,” “Missing parts,” “Wrong item sent”).

- When the system offers “Contact seller” or “Message seller,” select it.

- Explain the problem clearly and attach photos if Amazon’s message system allows it.

Example message:

“Hi, I received my order today (Order #113-xxxxxxx). The product looks used and has visible scratches on the front panel. The packaging was also open. Can you please send a replacement or advise the best way to resolve this?”

What If There’s No “Contact Seller” Button?

Sometimes you won’t see a clear “Contact seller” option, either:

- The item is sold directly by Amazon

- The order is very old

- The seller is no longer active

In those cases, you still have options:

- If sold by Amazon: Use Amazon Customer Service via Help → Customer Service → Something else → I need more help (options change over time, but you’ll find chat/call/email).

- If the seller is inactive/unavailable: Open an issue via Your Orders → Problem with order and Amazon may step in.

- For orders outside the normal return window: You may still be able to message the seller, but Amazon’s A-to-z Guarantee and return policies might not apply. Still worth trying.

How Long Does It Take for an Amazon Seller to Reply?

Most third‑party sellers on Amazon are expected to respond within 24–48 hours.

A few tips to get faster, better responses:

- Be clear and concise – Long rants get skimmed. Short, specific messages get answers.

- Include your order number – Especially if you’re messaging from outside the order page.

- Attach photos when there’s physical damage, defects, or missing pieces.

- Check your email and Amazon messages – Replies may show up in both.

If the seller doesn’t respond in a reasonable time and your issue is serious (e.g., defective, not as described, missing package), contact Amazon Customer Service and/or start a return or A-to-z Guarantee claim (if eligible).

What Should You Say When You Contact a Seller?

You don’t need to write an essay. Just cover the basics:

- What the item is (and variation like size/color)

- Order number (if you’ve purchased already)

- Date you ordered/received it

- Clear description of your question or issue

- What you want (refund, replacement, missing part, clarification)

Example: Pre‑Purchase Question

“Hi, I’m interested in the 10-foot USB-C charging cable in black. Will this work with an iPad Pro 12.9" (2022 model)? And does it support fast charging at 60W or higher?”

Example: Post‑Purchase Issue

“Hi, I ordered the blue medium hoodie (Order #113-xxxxxxx) and received a small in red instead. Could you send the correct size and color, or should I process a return through Amazon?”

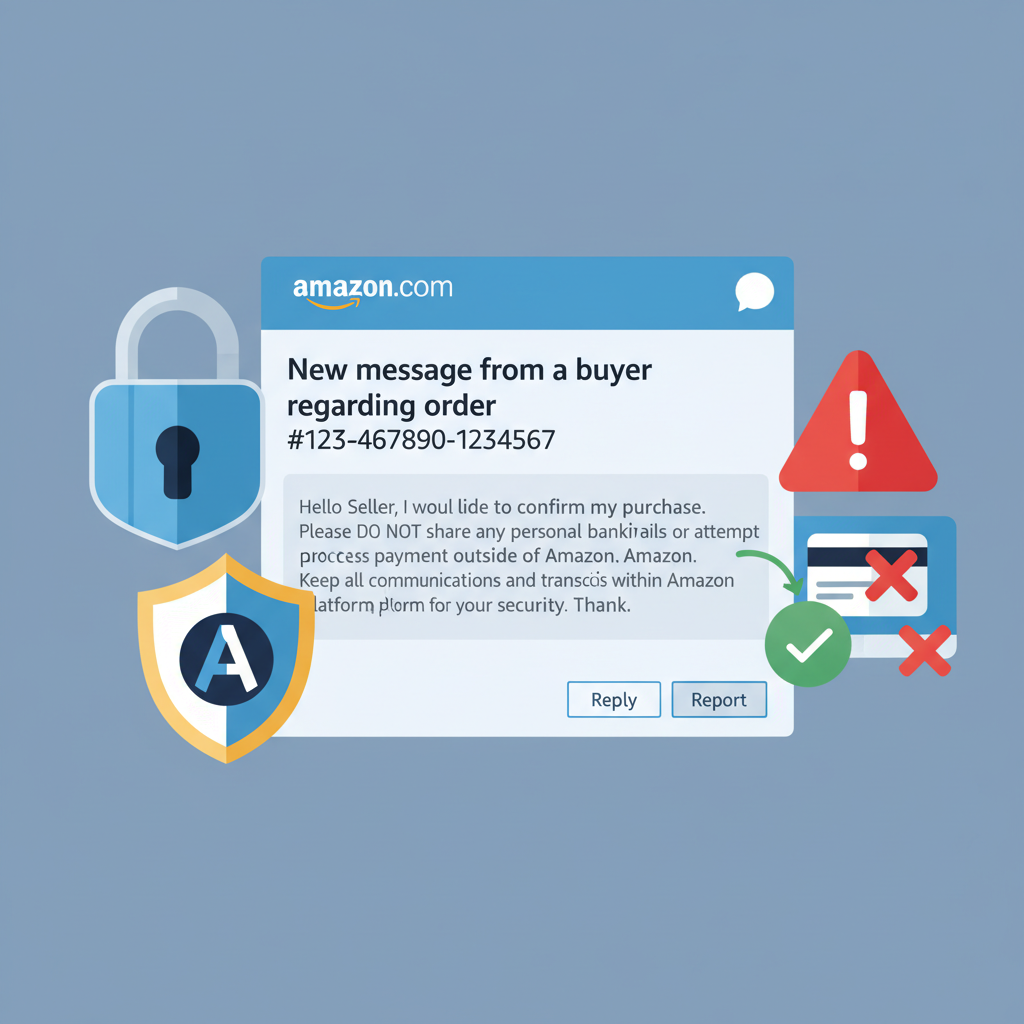

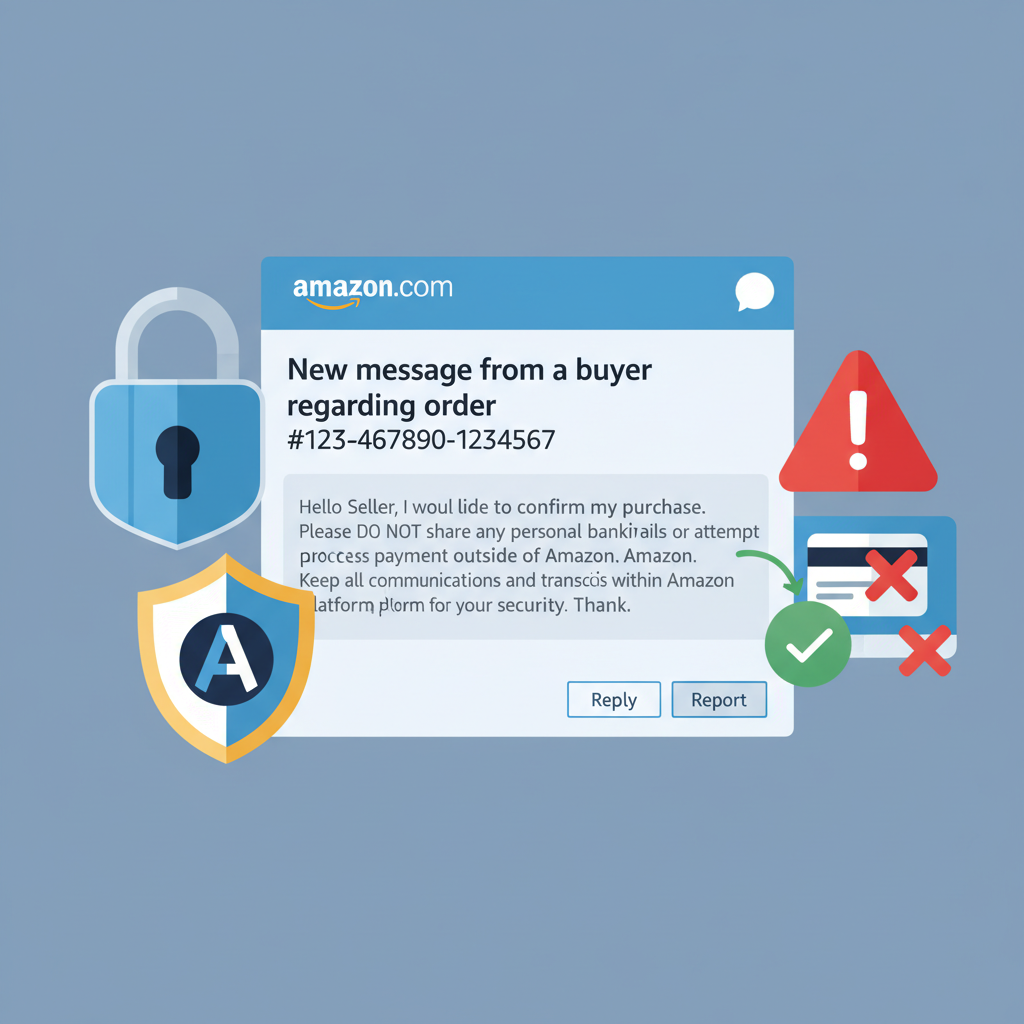

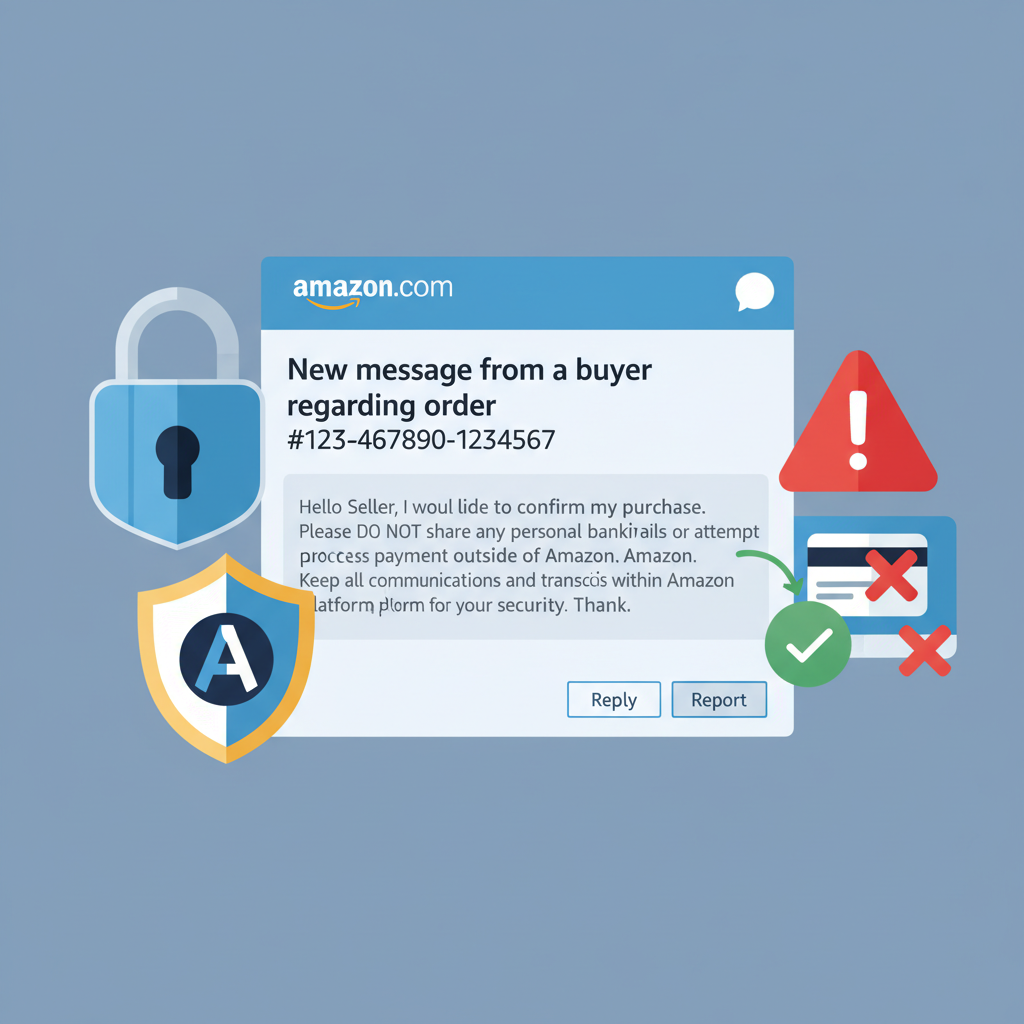

Safety Tips When Messaging Sellers on Amazon

- Keep everything inside Amazon’s messaging system. Don’t move to private email, text, or random messaging apps.

- Never share sensitive info like full credit card numbers, bank details, or passwords.

- Be cautious if a seller asks you to cancel your order and pay them directly via another website or payment method.

If anything feels off, report it through Amazon Help/Customer Service.

FAQ: Fast Answers About Contacting Amazon Sellers

Can I call an Amazon seller by phone?

Most sellers are contacted through Amazon’s message system, not by phone. Some might list a business phone number on their seller profile, but messaging is the standard and safest option.

Can I contact a seller without an Amazon account?

No. You’ll need to sign in to your Amazon account to message a seller.

Can I negotiate prices with a seller?

Not in the usual sense. Amazon listings are typically fixed price, and most sellers won’t negotiate in messages. However, you can ask about:

- Bulk discounts

- Different variations

- Upcoming restocks

Is it better to contact the seller or Amazon?

- Product-specific questions/defects? Start with the seller.

- Delivery issues, payment problems, or unresponsive seller? Go to Amazon Customer Service.

Final Recap: The Simple Formula

If you remember nothing else, remember this:

- Before buying → Product page → click seller name → Ask a question

- After ordering → Your Orders → find item → Problem with order / Contact seller

- After delivery issues → Your Orders → Problem with order → message seller or start a return

- No contact button or serious problem? → Go to Amazon Customer Service

Once you know where to look, contacting a seller on Amazon is actually pretty painless.

Now go get your questions answered—and maybe that perfect, actually compatible product too.