Amazon Operations Manager Salary Breakdown

So you’re wondering what an Operations Manager at Amazon actually makes—and whether the stress, the metrics, and the endless acronyms are worth it. Let’s talk real numbers, real hours, and real upside. This guide breaks down Amazon operations manager salary ranges, bonuses, stock, and what actually drives pay up (or quietly holds it back).

What Does an Operations Manager at Amazon Do?

Before talking salary, it helps to know what you’re actually getting paid for.

At Amazon, “Operations Manager” typically sits in the fulfillment and logistics world—think:

- Running parts of a fulfillment center (FC), sort center, or delivery station

- Managing large hourly teams (sometimes 50–200+ associates)

- Hitting aggressive targets on safety, quality, cost, and speed

- Partnering with area managers, HR, and senior ops leaders

In other words: you’re the person making sure thousands of packages move every hour without the building catching fire—figuratively.

Amazon Operations Manager Salary: The Big Picture

Comp for operations roles at Amazon is usually a mix of:

- Base salary (your guaranteed yearly pay)

- Bonus (often performance-based)

- RSUs (restricted stock units in Amazon, usually vesting over several years)

Pay varies a lot by:

- Level (Ops Manager I vs II vs Sr.

- Location (California > Midwest, generally)

- Experience and performance

When people say “Amazon operations manager salary,” they’re often talking about total compensation (base + bonus + stock) per year.

Typical Base Salary Range (U.S.)

While exact numbers vary by market and level, here’s what you’ll commonly see for Operations Manager roles in U.S. fulfillment operations:

1. Base Salary

Across U.S. postings and reports, many Operations Manager roles (mid-level) land roughly in this ballpark:

- Lower end: around $70,000–$85,000 per year

- Typical mid-range: around $85,000–$110,000 per year

- Higher-cost markets / more senior ops managers: can reach $120,000+ base

This is for core ops management—not senior regional directors or corporate roles.

2. Bonus & Performance Pay

Amazon’s bonus structure will vary by role and site, but you can often expect:

- Target bonuses in the range of 5–15% of base salary, sometimes higher for more senior roles

- Bonuses tied closely to site performance (safety, quality, productivity, cost) and your own review

So if your base is $100,000 and your target bonus is 10%, you’re aiming for $10,000 on top—though it’s not guaranteed.

3. RSUs (Amazon Stock)

For operations management levels that are considered “exempt” and higher-band roles, stock is often part of the package.

Typical patterns:

- RSUs are granted as a dollar amount at offer time (e.g., $40,000–$80,000+ worth of stock over several years)

- They vest over a 4-year schedule, heavily weighted toward years 3 and 4

- In strong stock years, RSUs can significantly boost your total comp

Entry-Level vs Experienced Operations Managers

Not all “operations manager” titles are created equal.

Entry-Level / Early-Career Operations Manager

These are often people with:

- 0–3 years of experience

- Maybe a bachelor’s in business, operations, engineering, supply chain, or similar

- Or strong internal promotion from area manager / shift supervisor roles

For this group, you’ll most commonly see:

- Base: roughly $70,000–$90,000 depending on location

- Bonus: modest but meaningful (often in that 5–10% range)

- Stock: may be smaller, but still part of the total package in many cases

Mid-Level / Experienced Operations Manager

These folks may have:

- 4–8+ years of experience

- Proven track record managing large teams, multiple departments, or complex sites

- Prior leadership roles in logistics, manufacturing, retail distribution, or military

Their comp might look more like:

- Base: around $95,000–$120,000+, especially in high-cost areas

- Bonus: higher percentage, sometimes with bigger upside when sites overperform

- Stock: more meaningful grants, especially if hired into higher levels

How Location Impacts Amazon Operations Manager Pay

Amazon adjusts pay based on local markets and cost of living.

Here’s how that shakes out in practice:

- High-cost areas (Seattle, San Francisco Bay Area, NYC, major metros):

- Higher base ranges

- Often more aggressive total comp (base + stock)

- Medium-cost areas (Dallas, Atlanta, Phoenix, Chicago suburbs):

- Solid mid-range base with competitive stock

- Lower-cost areas (some Midwest, South, smaller metros):

- Lower end of the salary range, but cost of living may still make it attractive

If you see the same title in two different locations at Amazon, don’t be surprised if there’s a $10K–$20K difference in base salary just because of location.

What Influences Your Salary as an Amazon Operations Manager?

Think of your pay as a function of three big levers:

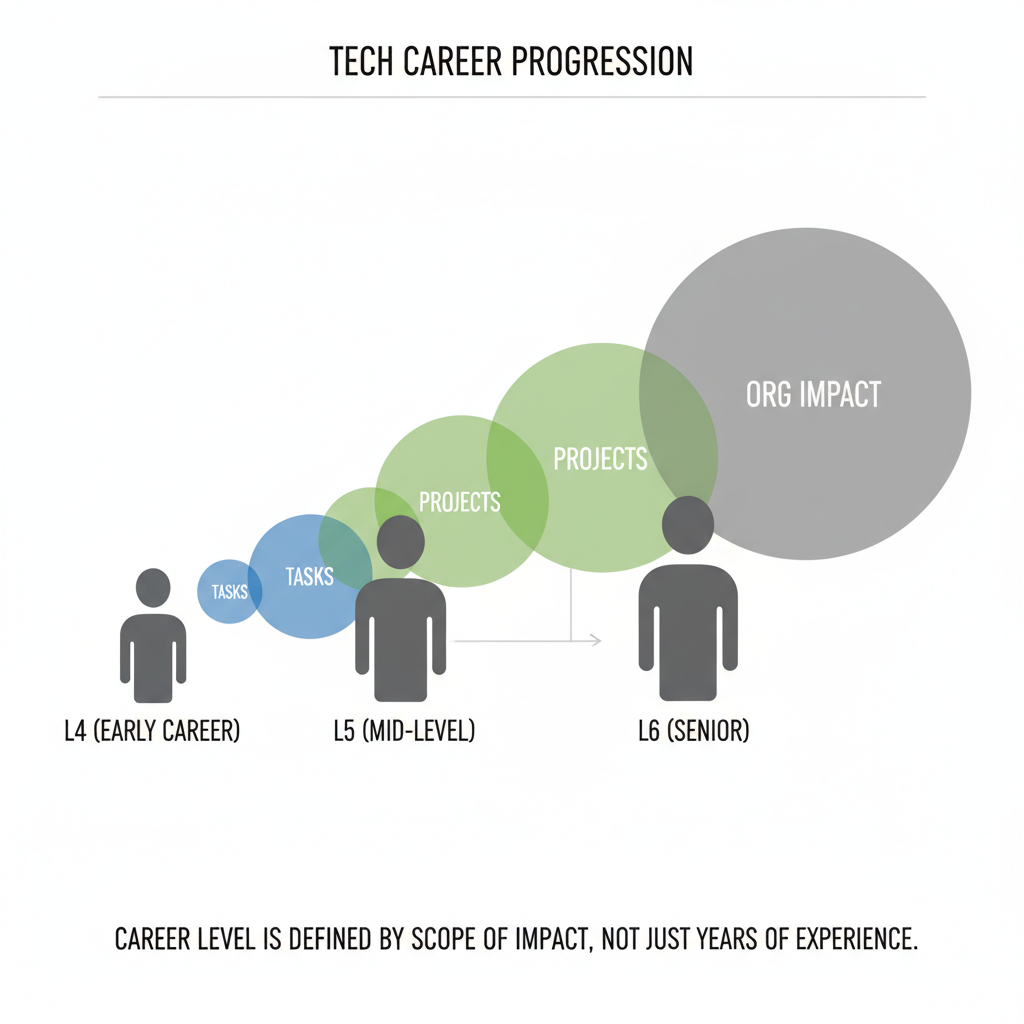

1. Level & Role Scope

More scope = more money.

- Managing a single department on one shift? That’s one level.

- Managing multiple departments, multiple shifts, or leading a large site’s core function? That’s a step up.

As your scope grows, Amazon is more likely to:

- Push your base higher

- Increase bonus targets

- Add more RSUs at promotion or refresh cycles

2. Performance & Promotions

Amazon is extremely data-driven. As an operations manager, your evaluation focuses on:

- Safety metrics (incident rates, compliance)

- Quality (defects, error rates)

- Productivity (units per labor hour, throughput)

- Leadership feedback and team engagement

Consistently strong performance:

- Makes you more competitive for promotion to higher levels (and higher pay bands)

- Can influence bonus payouts

3. Background & Negotiation

Yes, negotiation still matters—even in a structured environment.

You may negotiate more strongly if you bring:

- Prior experience at another major logistics/retail player (UPS, FedEx, Walmart, Target, etc.)

- Military leadership background, especially in logistics or operations

- An advanced degree (MBA, MS in Supply Chain, etc.)

Sample Total Compensation Scenarios

Let’s make this concrete with simplified, hypothetical examples.

Scenario 1: Early-Career Ops Manager in a Mid-Cost City

- Base salary: $82,000

- Bonus target: 8% ($6,560 if fully achieved)

- RSUs: $24,000 over 4 years (front-loaded more in years 3–4)

Approximate first-year total target:

Base + bonus + 1/4 of RSUs ≈ $82,000 + $6,560 + $6,000 = $94,560

Scenario 2: Experienced Ops Manager in a High-Cost Metro

- Base salary: $115,000

- Bonus target: 12% ($13,800 if fully achieved)

- RSUs: $60,000 over 4 years

Approximate first-year total target:

Base + bonus + 1/4 of RSUs ≈ $115,000 + $13,800 + $15,000 = $143,800

These aren’t official numbers—just realistic illustrations based on typical ranges and structures. Actual offers depend on site, level, market, and timing.

Is Being an Amazon Operations Manager Worth the Salary?

Money aside, you’re probably wondering: is the job actually worth it?

Here are the main tradeoffs people talk about:

Pros

- Strong leadership experience. You’ll manage big teams and budgets early.

- Fast-paced environment. If you like solving problems on the fly, you won’t be bored.

- Clear metrics. You’ll know very clearly if you’re winning or not.

- Brand name. “Operations Manager at Amazon” opens doors across logistics, tech, retail, and consulting.

Cons

- Long hours. Expect nights, weekends, or odd shifts depending on your site.

- High pressure. Metrics culture is intense. Performance is very visible.

- Physical environment. You’re on your feet a lot in warehouses, not sitting in a quiet office.

How to Maximize Your Pay as an Amazon Operations Manager

If you’re aiming for the higher end of the range, here’s how to stack the deck.

1. Target the Right Locations and Levels

- Look for roles in higher-paying metros if relocation is an option.

- Aim for positions where you have wider scope (more people, more departments) once you have experience.

2. Build a Quantitative Track Record

Even before Amazon, keep receipts:

- “Reduced processing errors by 18% while managing a 60-person team.”

- “Cut overtime by 12% while increasing throughput by 9%.”

Numbers justify higher bands during hiring and promotion decisions.

3. Negotiate Thoughtfully

When you receive an offer:

- Ask clarifying questions about base, bonus, and RSU structure

- Compare offers across locations and roles using total comp

- If you have competing offers or strong experience, respectfully push for the higher end of the range

4. Think in 2–3 Year Horizons

Amazon comp (especially RSUs) can really start to shine after year 2–3 as:

- More stock vests

- You become eligible for promotions and refreshers

Frequently Asked Questions About Amazon Operations Manager Salary

Do operations managers at Amazon get overtime?

Most Operations Manager roles are exempt (salaried), so instead of overtime, you’re compensated through base, bonus, and stock. Hourly roles (like many associates or some frontline leaders) may be non-exempt and eligible for OT, but full operations managers usually are not.

Can an Amazon operations manager make six figures?

Yes. Between base, bonus, and RSUs, total compensation can reach or exceed $100,000, especially in higher-cost markets or at more senior levels. In some cases, even base alone can be close to or above six figures.

Is the pay negotiable?

Within defined bands, there is some flexibility, especially around base and sign-on/stock. You’ll have the best shot at negotiating up if you bring in-demand experience or competing offers.

Final Thoughts: Is the Amazon Operations Manager Salary Right for You?

If you:

- Enjoy fast-paced, metrics-driven environments

- Want serious leadership responsibility early in your career

- Are okay with non-traditional hours and some stress

…then the Amazon operations manager salary—plus the growth, stock, and brand name—can be very competitive.

If, on the other hand, you want a chill 9–5 with no surprises, this probably isn’t your dream role, no matter the pay.

Next step:

- Check current postings in your target city

- Compare total compensation (base + bonus + RSU), not just salary

- Decide whether the experience and upside line up with your lifestyle and long-term goals

That’s how you know if the Amazon operations manager salary is not just good on paper—but good for you.