Amazon Layoffs: What’s Really Going On?

A brutally honest look at how Amazon is reshaping its workforce—and what it means for you.

If it feels like every few months there’s another headline about an Amazon layoff, you’re not imagining it.

Since late 2022, Amazon has gone from pandemic-era hyper‑hiring to some of the biggest job cuts in corporate history, and 2025 is shaping up to be another brutal chapter.

Let’s unpack what’s happening, why it’s happening, and what it actually means if you work in tech, retail, or anywhere near Amazon’s orbit.

Quick recap: How big are the Amazon layoffs?

Here’s the rough timeline of major Amazon layoffs since the pandemic:

- Late 2022 – early 2023: About 27,000 roles eliminated across corporate teams like devices, HR, and retail, one of Amazon’s first truly massive modern layoffs. According to multiple reports tracked by Layoffs.fyi and business media, these cuts landed heavily in divisions like Alexa, gaming, and communications.

- 2024: Smaller but steady restructuring waves touched communications, sustainability, and parts of the North America Stores team, with a few hundred jobs cut here and there as Amazon continued to “re-prioritize” around profitability and AI. (economictimes.indiatimes.com)

- October 2025: Amazon announces its largest corporate layoff since 2023—plans to cut around 30,000 corporate jobs, roughly 10% of its ~350,000 corporate workers. That’s on top of earlier reductions and targets non‑frontline roles in HR (especially the People Experience and Technology unit), operations, devices and services, and Amazon Web Services (AWS). (technology.org)

- Late 2025 follow‑ons: Inside that broader restructuring are more localized cuts, like 370 jobs at Amazon’s European HQ in Luxembourg and additional layoffs in Washington state, which include engineers and program managers. (timesofindia.indiatimes.com)

Put together, you’re looking at tens of thousands of Amazon jobs gone or going away between 2022 and 2025, mostly in corporate and tech roles rather than warehouses and delivery.

Takeaway: This isn’t a one‑off “oops, we over‑hired.” It’s a multi‑year strategic downsizing and reshaping of who Amazon employs and for what.

Why is Amazon laying off so many people?

There isn’t just one reason. It’s a cocktail of:

1. Pandemic over‑hiring that never fully unwound

Between 2019 and 2022, Amazon more than doubled its workforce to keep up with lockdown‑era demand. Online sales exploded, logistics networks ballooned, and the company staffed up accordingly. (indmoney.com)

When people went back to stores and demand normalized, Amazon was left with:

- Teams sized for a once‑in‑a‑century surge

- Growth curves that flattened

- Profit pressures from rising costs and slower e‑commerce expansion

So some roles became redundant—not because the workers were bad, but because the business reality changed.

Takeaway: Amazon built for 2030 demand, then discovered it was still living in 2024.

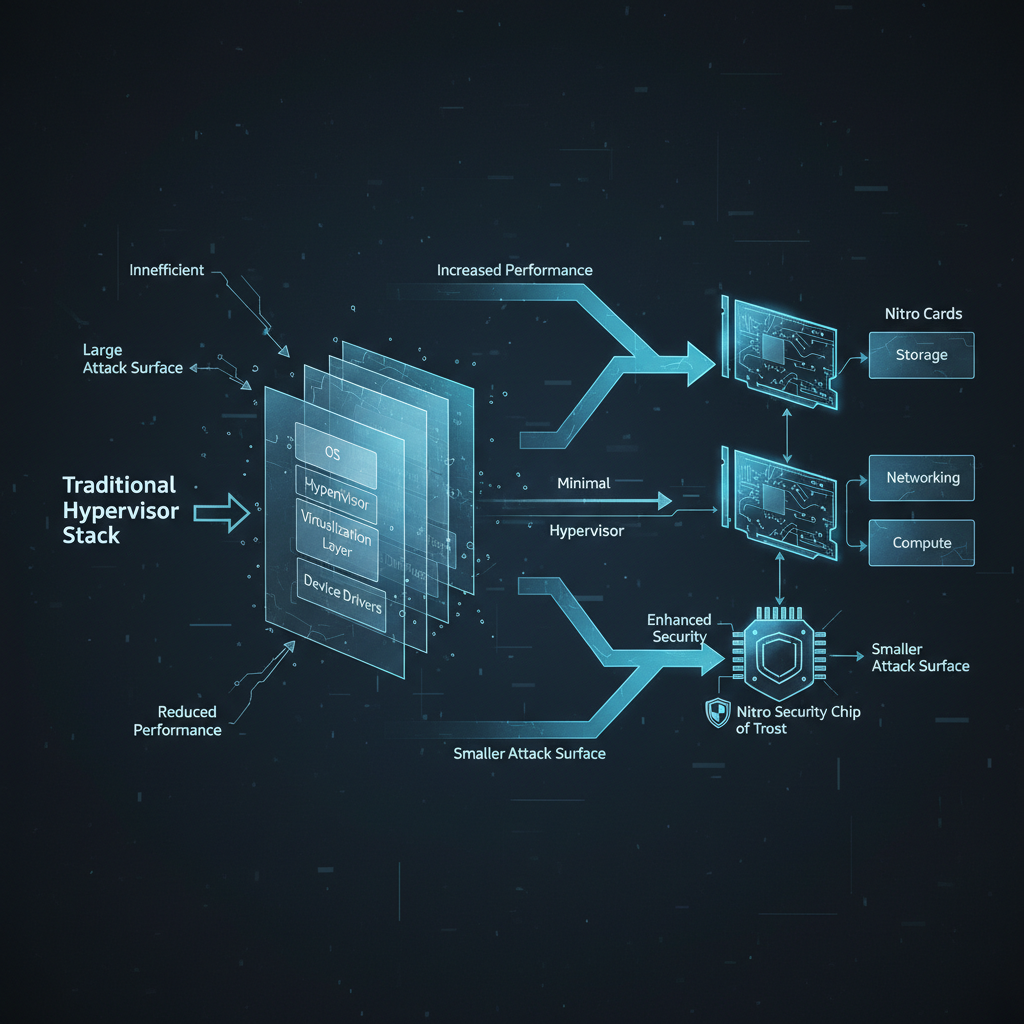

2. AI and automation are officially “the main character”

Amazon isn’t shy about this: leadership repeatedly says AI is as transformative as the early internet, and they’re reorganizing the company around it. (theoutpost.ai)

That shows up in two ways:

- Corporate and admin roles: Advanced AI is now handling forecasting, data analysis, logistics planning, and even parts of customer support. That reduces the need for large, layered management structures and some mid‑level roles.

- Operations and fulfillment: Investments in robotics and automation mean Amazon can run warehouses and logistics networks with fewer humans per package processed—a trend that’s still in early innings. (indiatoday.in)

Leadership is blunt: if AI or automation can do something cheaper, faster, and at scale, Amazon will absolutely go that way.

Takeaway: These layoffs aren’t just cost cuts—they’re a workforce swap: fewer traditional roles, more AI, robotics, and hard‑tech work.

3. Cost control and Wall Street pressure

Amazon’s investors care about profitability, not just growth.

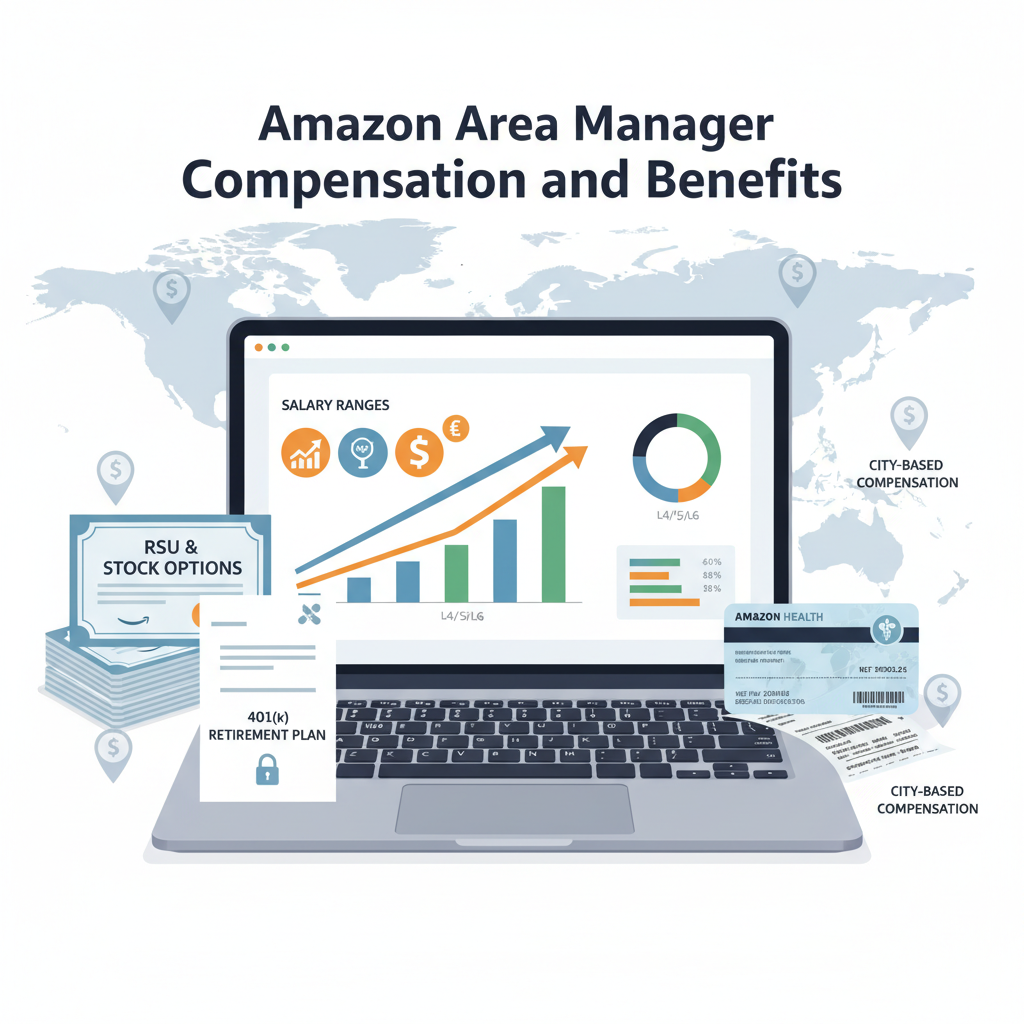

- Analysts estimate that cutting roughly 13,800+ managerial roles could save $2.1–$3.6 billion per year, given typical salary bands. (economictimes.indiatimes.com)

- At the same time, Amazon’s capital spending is exploding, jumping toward $100 billion a year to fund data centers, chips, and infrastructure for AI and cloud. (techxplore.com)

To reconcile “spend big on AI” with “please improve margins,” Amazon is trimming headcount, especially in roles perceived as bureaucratic or duplicative.

Takeaway: The math is simple: fewer people + more AI + higher capital spend = a business that looks leaner on paper.

4. “Too much bureaucracy” (Amazon’s words, not mine)

Andy Jassy and senior leaders talk a lot about removing layers and running Amazon “like the world’s largest startup.” (businessinsider.com)

Some signals:

- The company launched a “Bureaucracy Mailbox” in 2024 so employees could report inefficiencies, and claims to have already implemented hundreds of suggestions to streamline operations.

- Internal messaging around the 2025 layoffs repeatedly mentions simplifying org structures, “faster decision‑making,” and pushing for “more ownership” per person. (economictimes.indiatimes.com)

In practice, this often translates into:

- Fewer managers

- Larger spans of control

- More pressure on the people who remain

Takeaway: If you’ve ever thought “This meeting could’ve been an email,” Amazon is trying to fire the meeting.

Who is most at risk in Amazon layoffs?

From what’s been reported so far, the most affected roles aren’t warehouse pickers—they’re corporate and office‑based jobs.

Based on recent rounds:

- Human Resources / People Experience and Technology (PXT): Some estimates suggest up to 15% cuts in certain HR areas, as automation handles more of the routine work and the org gets smaller overall. (ibtimes.co.uk)

- Operations & corporate support functions: Program managers, operations analysts, and other backbone roles are being thinned out, especially where AI tools or new systems reduce manual coordination.

- Devices and Services (e.g., Alexa, some consumer hardware): This division has already seen several waves of cuts as Amazon re‑evaluates long‑term bets and prioritizes what it thinks can actually make money.

- AWS and related cloud units: Not immune. Even though AWS is Amazon’s profit engine, it’s also being restructured to align with AI and cloud priorities, meaning some older or non‑core initiatives get trimmed. (technology.org)

Meanwhile, Amazon is still hiring aggressively in:

- AI and machine learning

- Cloud infrastructure and chips

- Robotics and automation

- Certain logistics and seasonal operations (think: 250,000 seasonal roles during peak holiday demand, even while corporate staff are being cut). (business-standard.com)

Takeaway: It’s less “Amazon is shrinking” and more “Amazon is changing what kinds of jobs it wants to pay for.”

What it feels like on the inside (and yes, it’s messy)

Public announcements are polished; the internal experience is not.

Common themes from internal memos and reporting:

- Drawn‑out anxiety: Many 2025 layoffs were telegraphed in advance (“restructuring,” “role reviews,” “multi‑year transformation”), leaving teams in limbo for weeks or months.

- Return‑to‑office as a pressure valve: Reports suggest that strict in‑office requirements in 2025—five days a week in some orgs—were partly intended to nudge people to quit voluntarily. Employees who didn’t comply risked being treated as voluntary resignations, sometimes with reduced severance. (technology.org)

- Patchwork severance: Corporate employees generally receive some combination of notice periods, internal transfer chances, and severance, but the exact package can vary widely by role, geography, and business unit. Recent memos mention things like 90 days to apply internally before termination. (theoutpost.ai)

Takeaway: From the outside, this looks like “rational restructuring.” From the inside, it often feels like months of uncertainty followed by a calendar invite titled something like “Discussion about your role.”

If you work at Amazon (or a similar company), how do you protect yourself?

No, you can’t single‑handedly stop macroeconomics or AI trends. But you can make yourself less layoff‑target‑shaped.

1. Move closer to revenue, AI, or infrastructure

Roles that:

- Directly drive revenue (sales, high‑impact product, key customer teams)

- Build or run AI, cloud, or core infrastructure

- Own clearly measurable outcomes

…tend to be safer than roles that just “support” or “coordinate.”

If you’re in a support role, look for ways to:

- Own specific metrics (e.g., “I reduced ops defects by 18% in my area”).

- Attach your work to clearly strategic initiatives—especially AI, automation, or cost savings.

2. Learn the tools that are changing your job

If AI and automation are why jobs are being cut, you have two choices:

- Compete with the tools

- Learn to run the tools

Guess which group gets laid off first.

Even if you’re not an engineer, getting comfortable with:

- Data analysis tools

- Internal automation platforms

- AI‑powered productivity or operations tech

…makes you more valuable and harder to replace.

3. Assume nothing is permanent: build your external optionality

Even in a company as huge as Amazon, stability is not guaranteed.

Start now:

- Keep your LinkedIn, résumé, and portfolio up to date.

- Maintain a warm network—ex‑coworkers, recruiters, people at partner firms.

- Save an emergency fund if you can; severance is helpful but not always predictable.

- Track internal and external openings, even if you’re not actively applying.

If the worst happens, you’re already in motion instead of starting from zero in panic mode.

4. Mentally separate your identity from your job

This is the hard one.

When layoffs happen, high‑achieving employees often internalize it as personal failure. But these cuts are clearly driven by macro strategy—AI shifts, capital allocation, investor expectations—not by the individual worth of the people leaving.

Your value is not defined by one company’s spreadsheet.

Takeaway: Use Amazon’s restructuring as a forcing function: upgrade your skills, relationships, and financial buffer before you need them.

What do Amazon layoffs mean for the broader job market?

Amazon isn’t operating in a vacuum.

In 2025 alone, tens of thousands of roles across tech and adjacent industries—Meta, Microsoft, Intel, UPS, TCS, and others—have been cut as companies retool around AI and automation. (businessinsider.com)

A few big-picture implications:

- Corporate tech roles are less “safe” than they felt in the 2010s. Even profitable companies will cut aggressively if they think their org chart is bloated.

- AI is replacing some jobs and creating others, but not at the same company, in the same city, or on the same timeline. You might lose a logistics PM role in Seattle and find your best opportunity is an AI operations role in Austin or a different industry entirely.

- Regulators and policymakers are watching. When a single employer like Amazon can erase or shift tens of thousands of jobs in a few years, conversations around labor protections, retraining, and AI governance get louder.

Takeaway: Amazon is both a mirror and a megaphone. What happens there is likely to echo across the rest of the economy.

So… should you be worried?

If you:

- Work in a large corporate environment

- Are in a role that’s mostly coordination, documentation, or internal support

- Rarely touch AI, automation, or direct revenue

…then yes, you should be paying attention—not in a “panic at 2 a.m.” way, but in a “time to update my playbook” way.

On the other hand, Amazon’s story is also a roadmap:

- Follow where the company is investing, not just where it’s hiring.

- Shift into roles that build or leverage AI, automation, or revenue‑critical products.

- Treat stability as something you create for yourself, not something any employer can guarantee.

The Amazon layoffs are brutal, but they’re also brutally clear about where work is headed.

Your move is to get ahead of that curve—before a calendar invite with an ominous subject line forces you to.