Amazon 401(k) Match Explained Simply

If you work at Amazon and you kind of know there’s a 401(k) match but aren’t totally sure how it works… you’re not alone.

You’ve probably heard things like:

- “Amazon doesn’t match that much.”

- “It gets better after a few years.”

- “I think there’s a cap? Maybe?”

Let’s clean this up so you actually know how much free money you’re leaving on the table (or hopefully not leaving).

Quick note: Amazon tweaks benefits from time to time. Always confirm with your latest benefits guide or A to Z / internal HR portal for the most current numbers.

What is the Amazon 401(k) match, in plain English?

At a high level, Amazon offers:

- A traditional 401(k) and Roth 401(k) option through its retirement plan.

- A company matching contribution based on a percentage of your eligible pay, up to a yearly dollar cap.

- Contributions that vest over time, meaning the money becomes fully yours after you’ve worked there a certain number of years.

The exact percentages and caps can vary by role, location, and plan year, but the core idea stays the same: Amazon will put in extra money toward your retirement if you contribute.

How a typical 401(k) match works (using Amazon-style numbers)

Even if Amazon adjusts the exact numbers, the mechanics tend to look like this:

-

You contribute a percentage of your paycheck

Example: You choose to save 5% of your salary into your 401(k). -

Amazon matches up to a certain percentage of pay

For illustration, imagine Amazon matches 50% of the first 4% of your eligible pay.

That means if you contribute at least 4%, Amazon throws in an extra 2%. -

There’s an annual cap

Even if you earn a very high salary, Amazon’s match usually won’t exceed a set dollar amount each year. -

Your contributions vs. Amazon’s contributions

- Your money (employee contributions): Always 100% yours, immediately.

- Amazon’s money (match): Usually subject to a vesting schedule.

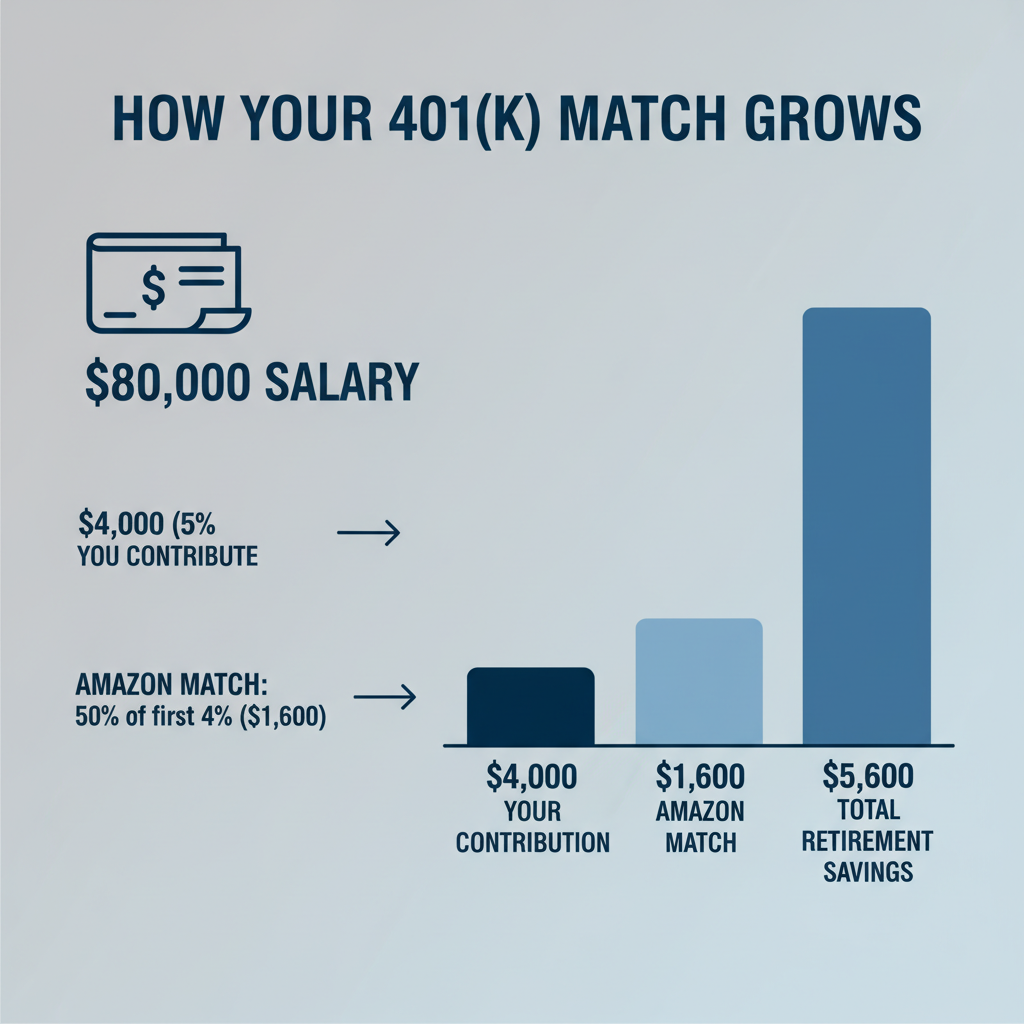

Example: $80,000 salary

Say you earn $80,000 per year and contribute 5%:

- Your contribution: 5% of $80,000 = $4,000 per year

- Match (example structure: 50% of first 4%):

- Amazon matches 50% × 4% of $80,000 = 0.5 × $3,200 = $1,600

So instead of just $4,000 going into your 401(k), you now have $5,600 going in.

What does “vesting” mean for Amazon’s 401(k) match?

Here’s where a lot of people get tripped up.

Vesting = when the employer contributions (Amazon’s match) become fully, permanently yours.

- Your own contributions: 100% vested immediately.

- Amazon’s matching contributions: Usually vest over a few years.

Why vesting exists

Vesting is a way companies encourage you to stay longer. If you leave before you’re fully vested, you may lose some (or all) of the employer match.

Example: 3-year vesting schedule (illustrative)

Let’s say Amazon uses a vesting schedule like:

- 0–1 year: 0% vested in employer match

- 1–2 years: 33% vested

- 2–3 years: 66% vested

- 3+ years: 100% vested

If you leave after 18 months:

- You keep all of your own contributions.

- You keep only 33% of the match that was contributed on your behalf.

If you stay 3+ years:

- You keep 100% of your contributions + 100% of vested employer match (and all investment growth on that money).

Should you choose Traditional or Roth 401(k) at Amazon?

Most big employers, including Amazon, now offer:

- Traditional 401(k) – contributions are pre‑tax, lower your taxable income now, but you pay taxes when you withdraw in retirement.

- Roth 401(k) – contributions use after‑tax money, no tax deduction now, but qualified withdrawals in retirement are tax‑free.

The company match typically goes into a traditional 401(k) bucket, even if you choose Roth for your own contributions.

How to think about your choice

Very simplified rules of thumb (not tax advice):

- If you expect to be in a higher tax bracket later → Roth can be attractive.

- If you need a tax break now or expect a lower tax bracket in retirement → Traditional can help.

- Many people split the difference: part Roth, part Traditional.

How much should you contribute to Amazon’s 401(k)?

You’ll see a lot of complicated advice online, but let’s keep it simple.

Step 1: At minimum, get the full Amazon 401(k) match

Whatever the match formula is in your current plan, aim to contribute at least enough to get 100% of that match.

- If Amazon matches up to 4% of pay → contribute at least 4%.

- If you can’t afford that yet, start lower and auto‑increase 1% per year until you do.

Skipping the match is like saying, “No thanks, I don’t want part of my compensation.”

Step 2: If you can, go higher

For 2025–2026, the IRS sets annual 401(k) contribution limits (your own contributions, not counting employer match). These limits usually increase over time to keep up with inflation.

If you’re able to:

- Get the full Amazon match first.

- Then, once you’re comfortably doing that, you can:

- Increase contributions by 1–2% per year, or

- Set a target (e.g., 10–15% of income) and work up to it.

Step 3: Don’t forget RSUs and other benefits

If you’re at Amazon, there’s a good chance part of your compensation is in restricted stock units (RSUs). Those can be a big part of your financial picture.

A basic priority order many employees use:

- Emergency fund (1–3 months of expenses to start, 3–6+ months as a more stable target).

- Contribute enough to Amazon’s 401(k) to get the full match.

- Pay down any high‑interest debt (especially credit cards).

- Increase 401(k) contributions, invest RSU proceeds smartly, and consider IRAs or other accounts.

What happens if you leave Amazon? (Your 401(k) options)

People don’t always stay at one company forever. When you leave Amazon, you generally have a few options for your 401(k):

-

Leave it in the Amazon plan (if allowed)

- Pros: Simple, no immediate action or taxes.

- Cons: Limited to that plan’s investment menu and rules.

-

Roll it into a new employer’s 401(k)

- Pros: Everything in one place, preserves tax advantages.

- Cons: Depends on how good your new employer’s plan is.

-

Roll it into an IRA

- Pros: Often more investment choices, more control.

- Cons: You’re on your own for choosing investments and providers.

-

Cash it out (usually the worst option)

- Taxes + possible early‑withdrawal penalties.

- You lose out on decades of compounded growth.

Also remember vesting:

- Any unvested Amazon match may be forfeited if you leave before you’re fully vested.

- 100% of your contributions and any vested match are still yours.

Common Amazon 401(k) mistakes to avoid

A lot of Amazon employees make the same avoidable mistakes. Here are a few to watch out for:

1. Not enrolling or delaying enrollment

Whether you’re hourly, corporate, or somewhere in between, it’s easy to say “I’ll set that up later” and then… it’s December.

Fix: Enroll as soon as you’re eligible and at least contribute enough to get the full match.

2. Contributing, but not enough to get the full match

Example: Amazon matches up to 4%, and you’re contributing 2%. That’s half the free money.

Fix: Check your current contribution rate in the benefits portal. If it’s below the match threshold, increase it today.

3. Ignoring vesting when planning a job change

If you’re close to a vesting milestone (like hitting 1 or 3 years of service, depending on your plan), leaving even a couple months early could cost you thousands.

Fix: Before you make a move, confirm:

- Your vesting schedule

- How much of the match is currently vested

- How much you’d forfeit if you left on a certain date

4. Letting all your investments sit in one default fund

Default funds (like target‑date funds) are often reasonable for many people, but they’re not the only option.

Fix: At least once a year, review:

- Your investment options

- Your risk level (stock vs. bond mix)

- Whether your choices still match your time horizon and comfort with risk

Action checklist: Dial in your Amazon 401(k) match in 20 minutes

- Log in to your Amazon benefits/401(k) portal.

- Find your current contribution rate (percentage of pay).

- Find the exact Amazon 401(k) match formula and the vesting schedule.

- Increase your contribution (if needed) to at least the level that gets the full match.

- Turn on auto‑increase (1% per year is a great nudge).

- Glance at your investment allocation to make sure it matches your risk tolerance and time horizon.

- Set a calendar reminder to review everything again in 6–12 months.

Do that, and you’ll be ahead of most of your coworkers.

Bottom line: Don’t sleep on the Amazon 401(k) match

Your salary, bonuses, and RSUs might get all the attention, but the Amazon 401(k) match is one of the quiet MVPs of your compensation.

- It’s free money—if you contribute enough.

- It can grow for decades with compounding.

- It rewards you more the longer you stay (thanks to vesting).

You don’t need to become a Wall Street pro. You just need to:

- Enroll.

- Contribute enough to get the full match.

- Stick with it and adjust over time.

Future‑you is going to be very pleased you treated that Amazon 401(k) match like the raise it actually is.

Leave a Reply