How Are Amazon Vine Items Taxed?

You signed up for Amazon Vine, started getting free products, and then… tax season showed up like an uninvited guest.

“Do I really have to pay taxes on free stuff?”

“Is Amazon sending this to the IRS?”

“Is this going to blow up my tax return?”

Let’s untangle it. This post walks through how Amazon Vine items are taxed in the U.S., what Amazon reports, what you are supposed to report, and some practical ways to avoid surprises.

Quick note: This is general educational info for U.S. taxpayers as of the 2025 filing season. For personalized advice, talk to a CPA or tax pro.

First things first: Are Amazon Vine items taxable at all?

Short answer: Yes, usually.

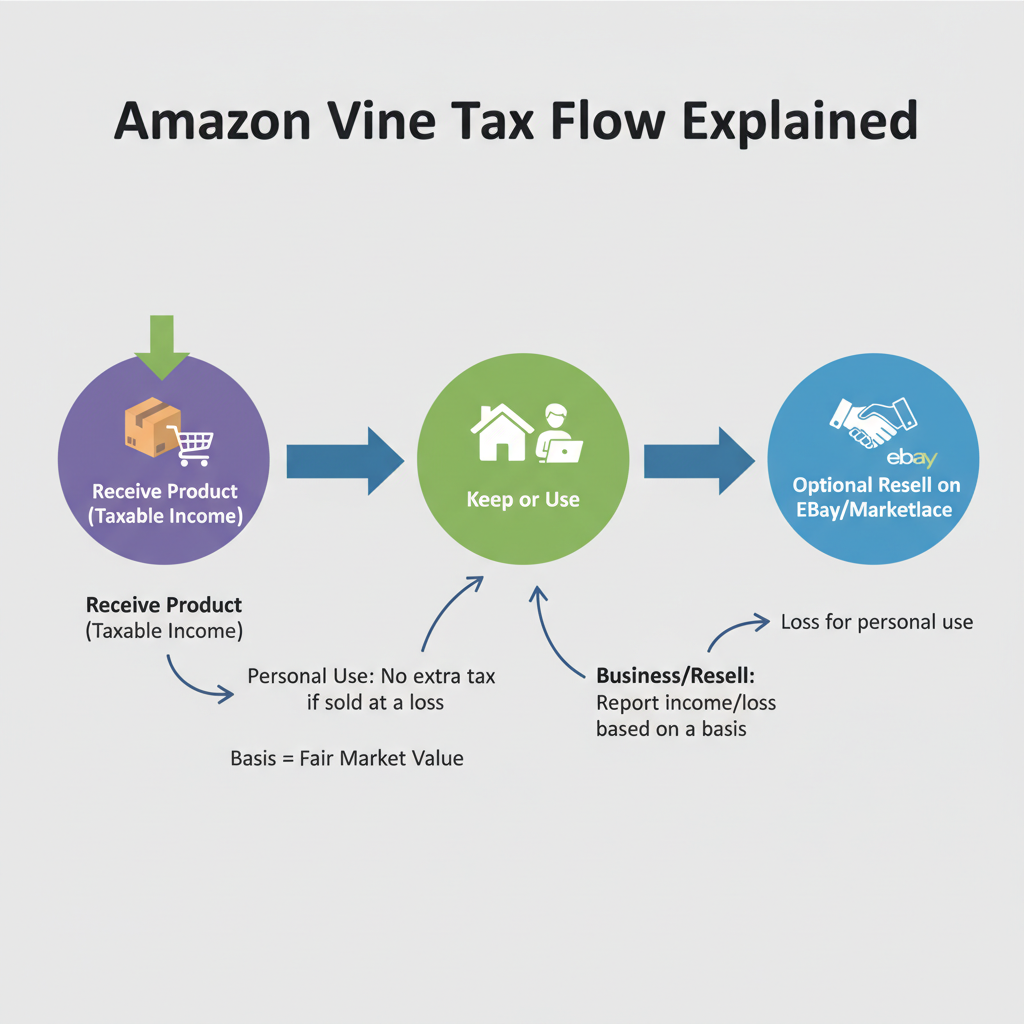

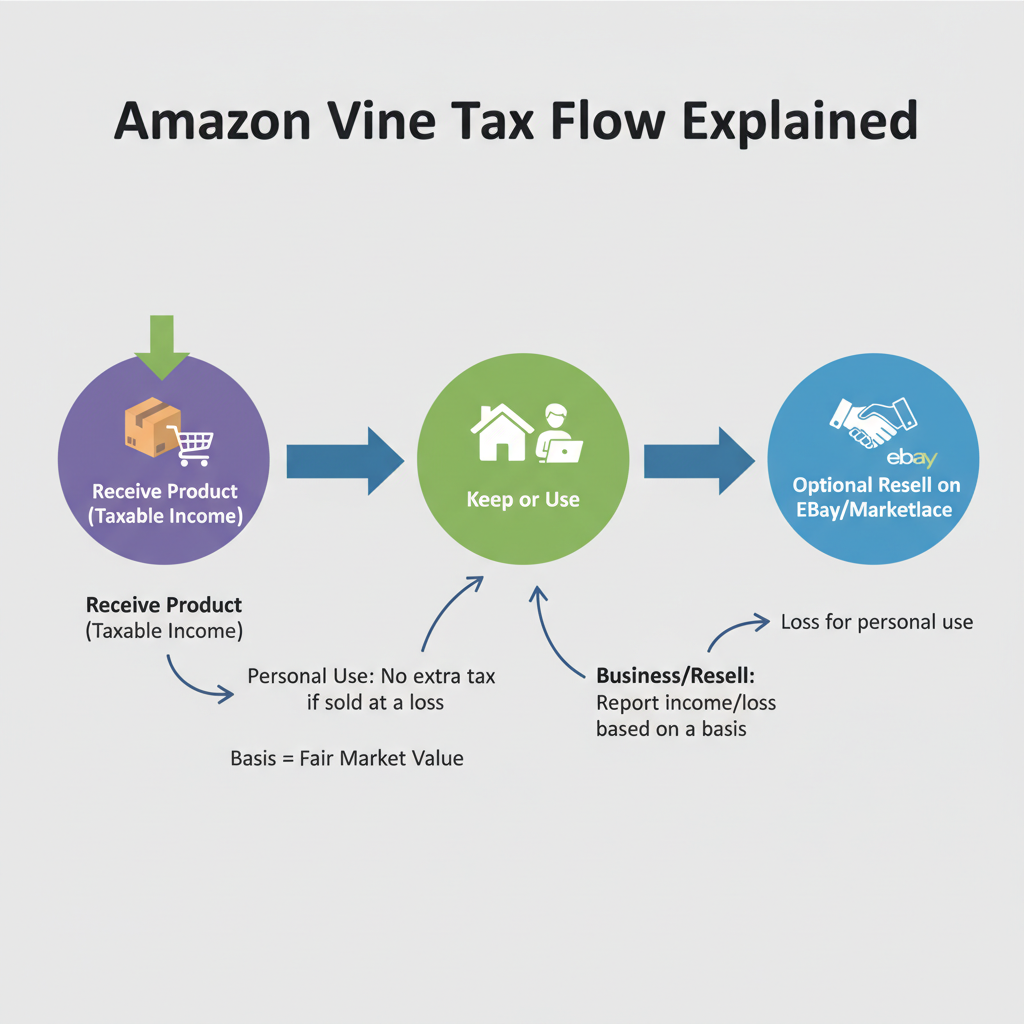

In the U.S., the IRS generally treats non‑cash compensation (like free products in exchange for reviews) as taxable income at its fair market value (FMV) on the date you receive it.

Amazon Vine is not a random giveaway. You:

- Receive products in exchange for writing reviews.

- Agree to terms that make it more like a compensation/benefit program than a sweepstakes.

Because you’re providing a service (reviews) and getting something of value (products), the IRS can treat the product value as income.

How does Amazon report Amazon Vine items to the IRS?

Does Amazon send me a 1099 for Vine?

For many U.S. reviewers who hit certain thresholds, Amazon issues Form 1099‑NEC (or sometimes 1099‑MISC in earlier years) that includes:

- The total value of Vine products you received in the tax year (based on Amazon’s valuation)

- Possibly other reportable payments if applicable

The key concept:

If you cross IRS reporting thresholds (for example, $600 or more in non‑employee compensation for a year — a common threshold for 1099‑NEC under current rules), Amazon is generally required to issue a 1099 to you and the IRS.

Even if you don’t get a 1099, the income can still legally be taxable. The form is just a reporting mechanism, not what creates the tax.

Where do they get the product values from?

Typically, Amazon uses something close to:

- The list price or

- A defined Vine value in its internal system

This value can feel inflated compared to “what you’d actually pay” or resale value — but tax reporting usually uses fair market value, and big platforms use standardized numbers instead of debating every single SKU.

Where do you report Amazon Vine income on your tax return?

This depends on whether your Vine activity looks more like a hobby or a business.

Scenario A: You’re a casual Vine reviewer (no real business around it)

If you:

- Are not running a related business,

- Don’t monetize reviews elsewhere,

- Just review products on Amazon as an individual,

…then the IRS may view this as miscellaneous income.

Typical reporting:

- Form 1040, Schedule 1 – Additional Income

You’d list it as something like “Amazon Vine product income” for the year.

The downside?

As a pure hobby / miscellaneous income, you usually can’t deduct related expenses the way a business can.

Scenario B: You run a content or review business (blog, YouTube, TikTok, etc.)

If you:

- Monetize your reviews (ad revenue, affiliate links, sponsorships), or

- Treat your reviewing as a side hustle/business,

…then the value of Vine items is often treated as business income.

Typical reporting:

- Schedule C (Profit or Loss From Business) attached to your Form 1040

Pros of treating it as a business:

- You include the value of Vine items as revenue, but

- You may be able to deduct ordinary and necessary expenses:

- Website hosting

- Lighting, camera, editing software

- A portion of your home office (if you qualify)

- Other tools used in the business

Casual reviewer? Likely miscellaneous income on Schedule 1.

Creator/brand/review business? Likely business income on Schedule C, with potential deductions.

Always confirm the right treatment with a tax professional based on your situation.

How do you figure out how much income to report?

The income is usually the fair market value of the products when you receive them.

Step 1: Start with Amazon’s number

If Amazon sends a 1099‑NEC/MISC, it likely reflects:

- The aggregate value of all Vine items you received that year.

That number is your starting point. It’s what the IRS sees.

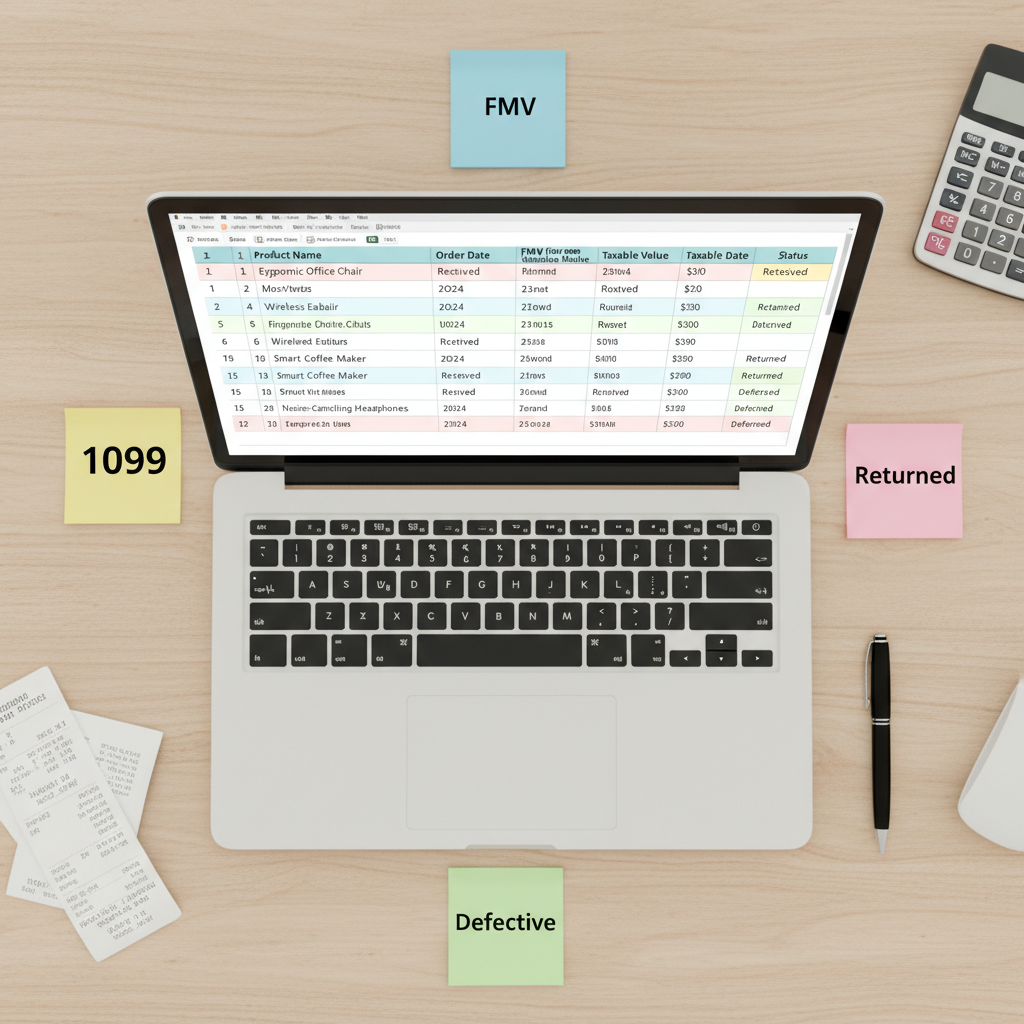

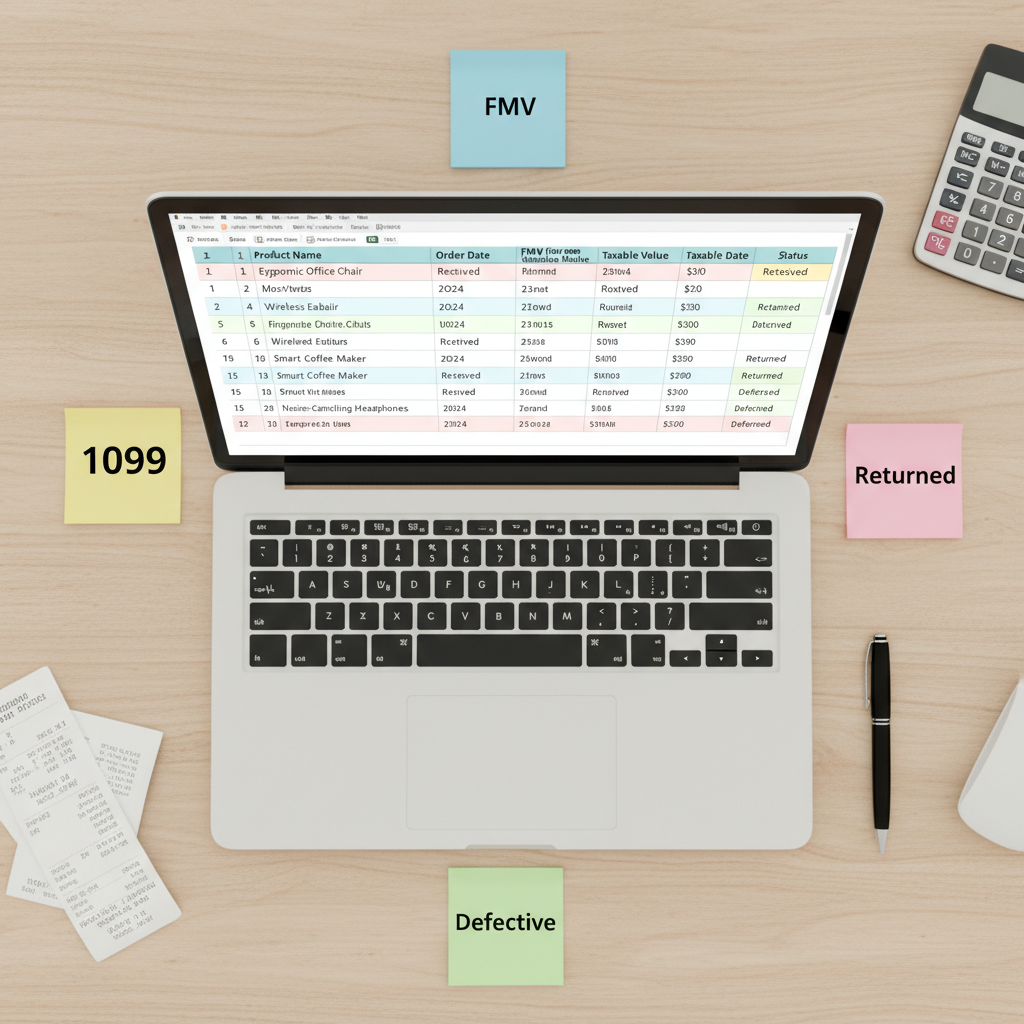

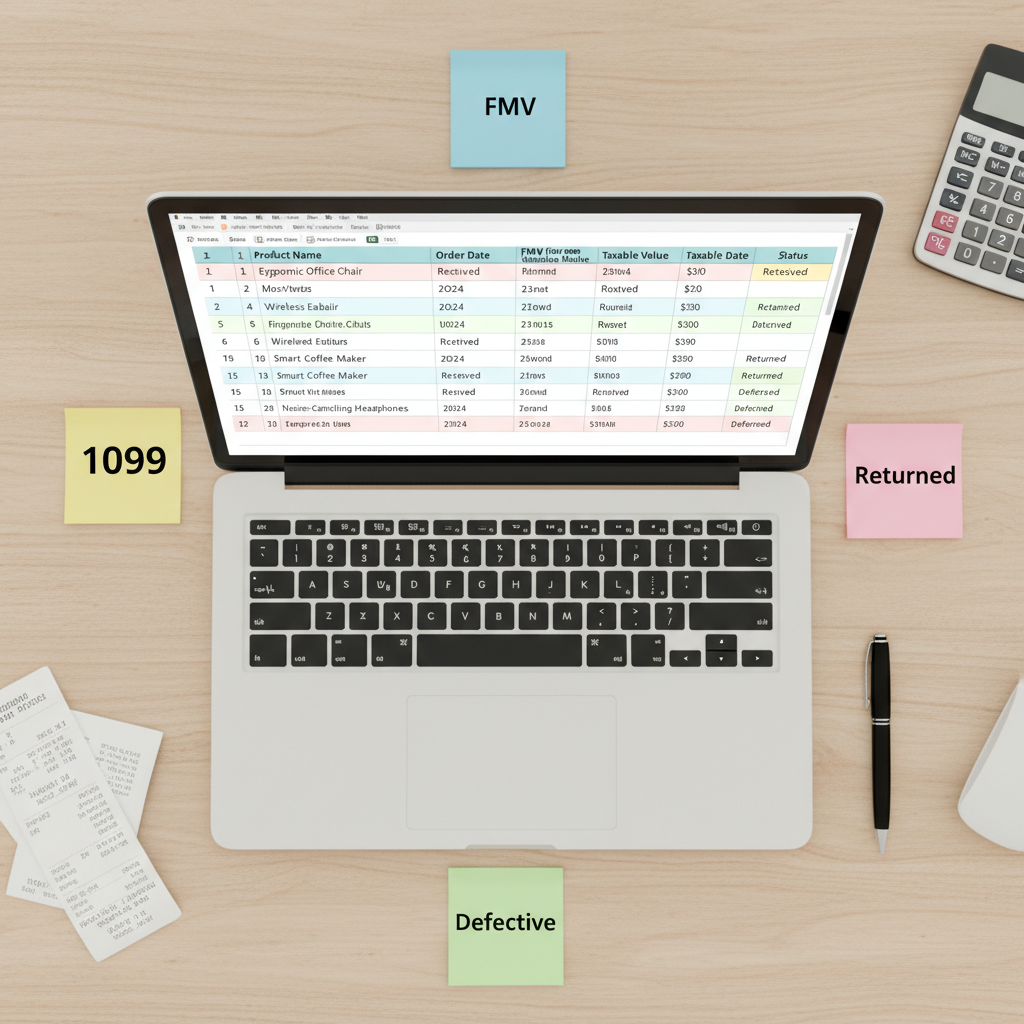

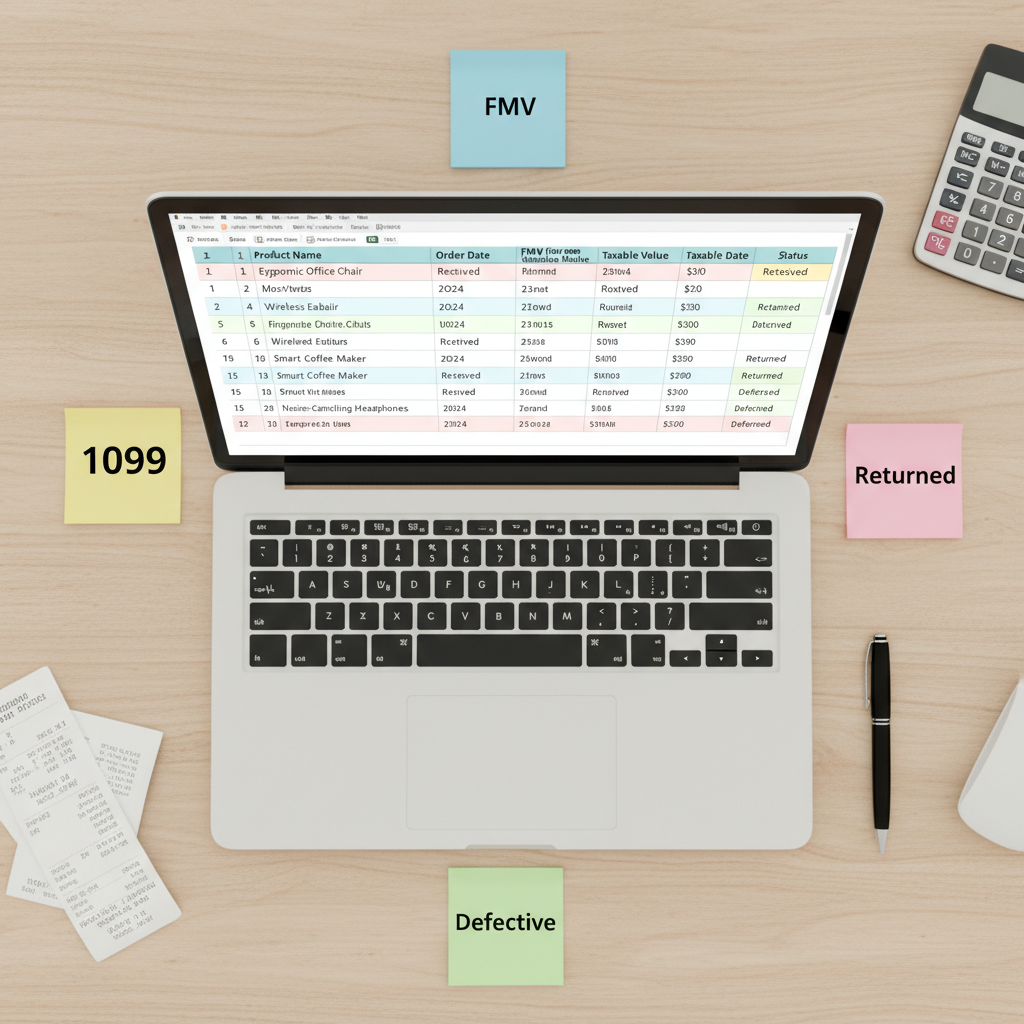

Step 2: Keep your own records

Don’t rely only on Amazon’s form. Maintain a simple spreadsheet with:

- Product name

- Date received

- Value Amazon listed or approximate FMV

- Notes (e.g., “returned,” “defective,” “never arrived”)

If something is clearly wrong (e.g., item never arrived but is in the list), you’ll want your own documentation in case you need to:

- Ask Amazon for a corrected 1099, or

- Explain discrepancies to your tax preparer.

Step 3: Handle discrepancies (if any)

If:

- Amazon’s 1099 includes items you never received, or

- The value is obviously off by a huge margin,

you can:

- Contact Amazon Seller/Vine/Tax support and request clarification or correction.

- If they don’t fix it, work with a tax pro to:

- Report the 1099 amount, and

- Back it out with an explanation statement and documentation, or

- Report your own corrected amount and attach a statement.

What if I never got a 1099 from Amazon?

Not getting a form does not automatically mean the income is non‑taxable.

Common reasons you might not get a 1099:

- Your total Vine product value didn’t cross the IRS reporting threshold for that year.

- Amazon doesn’t have your SSN/EIN set up for reporting yet.

- You moved or changed email and didn’t see it.

But the IRS rule of thumb is:

If you received income, it can be taxable, whether or not someone sent a form.

So:

- Add up your Vine product values for the year.

- Report them as income in the correct place (misc or business) anyway.

Can you deduct anything against Amazon Vine income?

This is where the difference between hobby vs. business really matters.

If Vine is just a hobby

Under current tax rules, hobby income is generally taxable, but hobby expenses are severely limited or not deductible the way they used to be (especially after changes in recent tax law).

Result:

- You may have to report the Amazon Vine income

- But not get matching deductions for your time, effort, or related costs

If Vine is part of a legitimate business

Then you may be able to deduct ordinary and necessary business expenses, such as:

- Software for editing photos or videos

- Website hosting, domain, email marketing tools

- Office supplies, portion of internet, etc.

More advanced scenario:

If you use some Vine products strictly for business — e.g.,

- A microphone used only for your YouTube channel recordings

- Lighting used only for product photo shoots

— a tax pro might treat those either as income and expense (you received it as income, then you “spent” it by using it for the business) or classify it as a business asset subject to depreciation. This gets technical fast, so don’t DIY complex treatment without help.

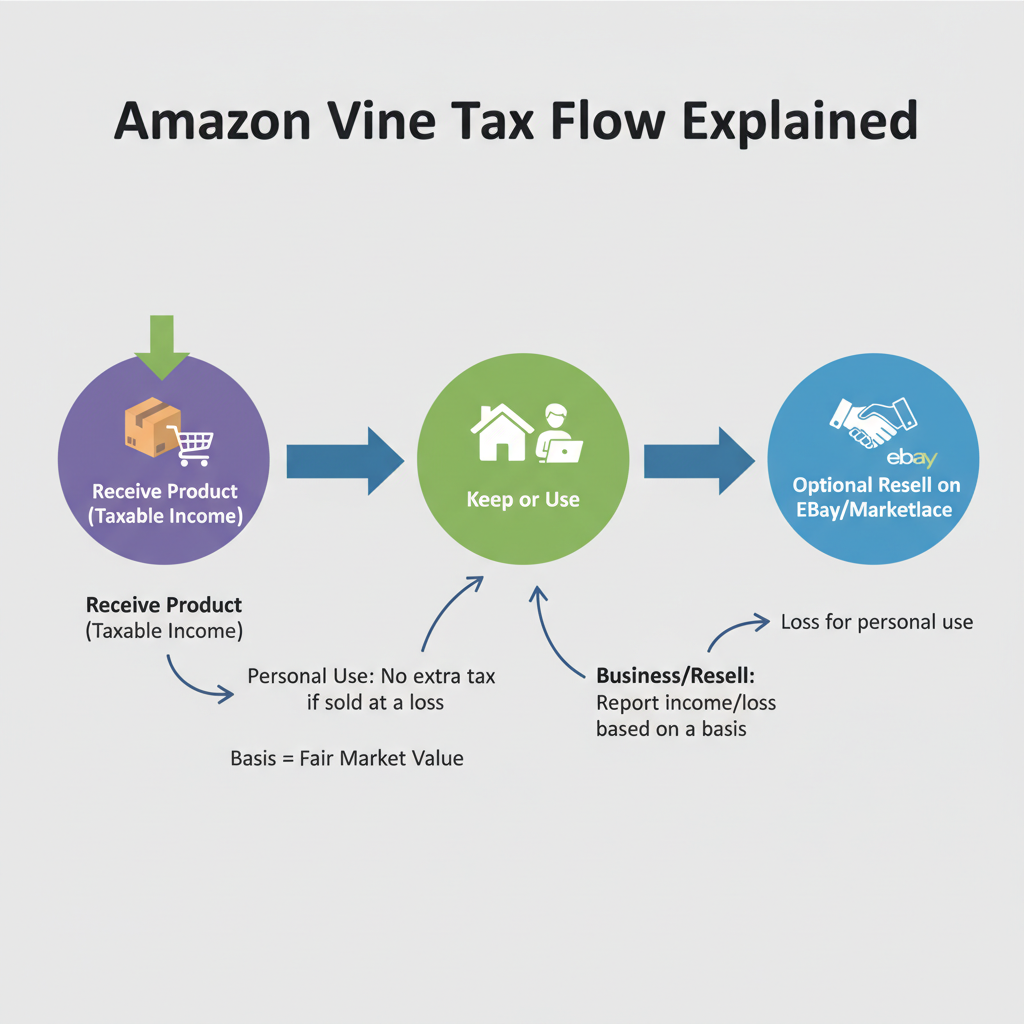

Do you pay tax when you sell Amazon Vine items later?

This is a big one: what if you resell your Vine products on eBay, Facebook Marketplace, or elsewhere?

Step 1: You were already taxed on the product’s value

When you received the Vine product, you were (in theory) taxed on its fair market value as income.

Step 2: You sell it — now what?

For tax purposes, your cost basis in the item is usually the value that was treated as income when you got it.

Example:

- Amazon counts a Vine product at $100 FMV in your 1099.

- You include that $100 as income.

- Later, you sell the item for $60.

Tax result (simplified, not legal advice):

- Your basis: $100 (you were taxed on that when you got it)

- Sales price: $60

- You don’t have a gain — in fact, you have a $40 loss.

But here’s the catch:

- Personal-use property losses are usually not deductible (you can’t claim a tax loss on selling your used personal stuff for less than you “paid”).

If it’s business inventory (you’re running a resale or content business), treatment may differ, and you’d want a pro to walk through it.

What records should Amazon Vine reviewers keep for taxes?

If you’re getting more than a couple items a year, get organized. Future‑you will be grateful.

Recommended records:

-

Annual spreadsheet

- Product name

- ASIN or link

- Date received

- Value (as listed in your Vine data, order page, or 1099 backup)

- Notes: used personally, used for business, resold, donated, defective, etc.

-

Copies of Amazon emails or dashboards

- Screenshots of Vine product value summaries

- End‑of‑year statements if Amazon provides them

-

1099 forms

- Download and keep PDFs in a tax folder each year

-

Resale records (if you sell items)

- Marketplace transaction download (eBay, Mercari, etc.)

- Date sold, sale price, fees

-

Business expenses (if applicable)

- Receipts for gear, software, hosting, etc.

Mini case studies: What this looks like in real life

Example 1: Casual reviewer, no business

Maria loves trying gadgets and leaves honest reviews on Amazon. In 2025:

- She receives $750 worth of Vine products.

- Amazon sends a 1099‑NEC showing $750.

Tax treatment:

- Maria reports $750 as other income on Schedule 1.

- She doesn’t have a content business and cannot claim major deductions against it.

Net effect: She pays federal (and possibly state) tax on $750, just as if she’d earned a small side job.

Example 2: Content creator with a real business

Jay runs a YouTube channel and blog reviewing tech products. He:

- Receives $3,000 worth of Amazon Vine tech gear

- Also earns ad revenue, affiliate commissions, and sponsorships

Tax treatment (simplified):

- Jay reports the $3,000 Vine value as business income on Schedule C.

- He also reports his ad/affiliate income there.

- He deducts business expenses: lighting, camera, editing software, part of internet, etc.

Net effect: Vine items increase his business revenue, but he can offset with legitimate business expenses, and possibly treat some items as business assets.

Example 3: Reselling Vine items

Kelly receives $1,200 worth of Vine products, all taxable.

Later, she sells a few items for a total of $400 on eBay.

- She was already taxed on the $1,200 as income.

- Her cost basis in those items is generally the value already taxed.

- Because she mostly used them personally and occasionally resold at a loss, she usually can’t deduct those losses as a casual seller.

Net effect: The main tax hit is when she receives the products, not when she sells them.

Practical tips to stay out of trouble (and reduce the sting)

- Assume Vine items are taxable unless a pro tells you otherwise.

- Track values as you go instead of trying to reconstruct a whole year in April.

- Decide early: Is this a hobby or are you building a real content/review business?

- If it’s becoming a business:

- Consider a separate bank account.

- Track income + expenses cleanly.

- Talk to a CPA or enrolled agent before tax season so you can structure things smartly.

- Budget for tax: If you get multiple high‑value items, mentally set aside a portion (e.g., 20–30% depending on your bracket) as “future tax money.”

Amazon Vine can be an amazing way to try products and grow a review brand. But from the IRS’s perspective, those “free” items are often taxable compensation. If you treat it like a real income source, keep records, and get proper advice, you can enjoy the perks without nasty surprises in April.

If you tell me a bit about your exact situation — casual reviewer vs. active content creator, approximate value of products, and whether you resell anything — I can help you map out a more tailored, step‑by‑step tax approach to Amazon Vine.

Leave a Reply